Bloomberg — It took Jaime Gilinski 561 days, and eight tries, but in the end he got his wish: wresting control of a century-old food conglomerate from Colombia’s most powerful business group.

And if the process of wearing down the tight-knit group of Medellin-based families was fitful and tortured, it was also immensely rewarding for Gilinski and his partners in Abu Dhabi. In taking control of food maker Grupo Nutresa SA, they’ve scored a profit of nearly 100% on the $2.7 billion they invested, capping off a coup that has upended the sleepy business community here and converted Gilinski — in the eyes of many — into a corporate raider villain in the mode of Carl Icahn.

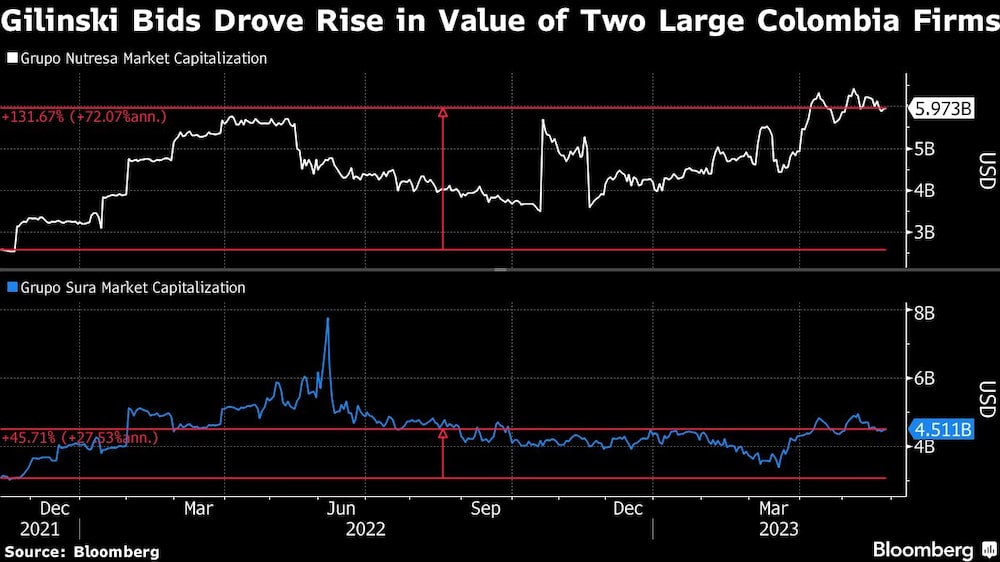

Gilinski, who is worth an estimated $4.4 billion, according to the Bloomberg Billionaires Index, unveiled his plans back in Nov. 2021 to buy a majority stake in Nutresa, Colombia’s largest food maker. Considered an outsider to Medellin’s business elite, Gilinski splits his time between homes in London, Miami and Colombia.

The company was controlled through a web of cross-holdings by the Grupo Empresarial Antioqueño (GEA), including the financial services firm Grupo Sura and cement maker Grupo Argos.

To untangle the structure, he began launching tenders to buy up stakes in all three companies. The moves sparked wild moves in the shares and startled the business executives behind the GEA who saw their long-running control of the firms at risk.

At times it seemed that his strategy had backfired as the tender offers fell short.

But after a sudden truce, Gilinski, 65, is now poised to take ownership of Nutresa, effectively dismantle the GEA, and come away with a massive windfall. He did so by partnering with Abu Dhabi’s royal family to build leverage in two of the companies and then using that position to pull off an all-stock deal that will give him a controlling stake in Nutresa worth $5.2 billion.

“The cross-holding structure, set to protect GEA companies from outsiders, ended up, in our view, being beneficial for Gilinski,” said Daniel Guardiola, a strategist at Banco BTG Pactual in Bogota. “It allowed this family to inflict pressure to the holding companies in different battlefields, which ultimately prepared the ground for a negotiation and forced GEA to give in and lose control of Nutresa.”

Details are expected to be announced June 15 with trading of the shares suspended until then. But as of now, the market capitalization of Nutresa, which produces and exports food products across Latin America, has surged to $6 billion from just $2.5 billion when Gilinski made his plans public. The memorandum of understanding signed with the GEA will give him and the royal family a stake of at least 87% in Nutresa in return for the roughly 40% stake they amassed in Sura being returned to the GEA.

The buyout strategy over the past 18 months unfolded against a tough backdrop, with Colombia electing its first leftist president and the peso slipping to record lows.

For Gilinski, who has worked closely on the deals with his son, Gabriel, it’s been the most public gamble of his career. Nutresa is now poised to be his top holding.

“This is a great deal,” said German Cristancho, head analyst at Davivienda Corredores brokerage. “They’ll end up with an attractive company, having paid a good price.”

In total, Gilinski and the royal family jointly have invested $1.2 billion of cash, with another $1.5 billion coming from a low-interest credit line from First Abu Dhabi Bank, according to a person with direct knowledge of the matter who asked not to be named discussing private talks.

After its tender offers, the takeover attempts became locked in a legal battle in Colombian courts that threatened to drag on for years. The Gilinskis and members of the GEA started hammering out a deal last month, the person said.

Gilinski has said he and his partners see massive potential for Nutresa to expand internationally. The company is the market leader in Colombia in a handful of categories, including ice cream, hamburgers and crackers. Founded a century ago as a chocolate maker, Nutresa sells food in 18 countries, operates 47 production plants and employs nearly 46,000 people.

Income before some expenses rose to roughly $450 million last year, an increase of 13% from 2021, on $4 billion of sales, according to data compiled by Bloomberg.

The plan for Nutresa includes investing in new plants and expanding the company’s brands for cold cuts, chocolates, coffee and cookies to emerging markets, including India, Pakistan and Bangladesh, the Middle East and parts of Africa, the person said. The company may eventually list Nutresa’s stock in Abu Dhabi, the person said.

Nutresa fits in one of the global verticals for the Royal Group — an investment vehicle for Sheikh Tahnoon bin Mohammed bin Khalifa Al Nahyan.

In a rare interview in November 2021, Gilinski told Bloomberg News he expected a long-term partnership with the Abu Dhabi royal family with potentially more deals to follow if the Nutresa takeover was successful.

“We have to first crawl and then walk and then run,” he said at the time.

After graduating from Harvard Business School, Gilinski returned to Colombia in the 1980s. Along with his father, who had a financial company, he bought the local branches of international bank BCCI in 1991.

Three years later, the family, along with a group of more than 80 institutional investors including George Soros, bought Banco de Colombia from the government in what was the biggest privatization in the country at the time. They later sold the stake in what has become Bancolombia SA, the country’s largest bank.

Some analysts speculated that Gilinski’s ultimate target in his advance against the GEA was again Bancolombia, of which Sura owns around 46% of the common shares.

In 2003, he bought Banco Sudameris, which now operates as Banco GNB Sudameris. It also has operations in Peru and Paraguay that were acquired from HSBC Holdings PLC in 2012. In 2019, he bought a stake in UK-based lender Metro Bank Plc.

His multibillion dollar empire also spans media and real estate sectors, including ownership of a Bogota news magazine, Four Seasons hotels in Colombia and a massive development on a former air force base near the Panama Canal. The family has experience in the food industry after starting snack company Yupi.

“Following a successful series of good deals in the past, controlling Nutresa would be without a doubt the largest and by far the most important deal so far for this family,” BTG’s Guardiola said.

Read more on Bloomberg.com