Bloomberg — The state of the US economy holds the key to who will win control of Congress in Tuesday’s midterm election — or at least, that’s what American voters say.

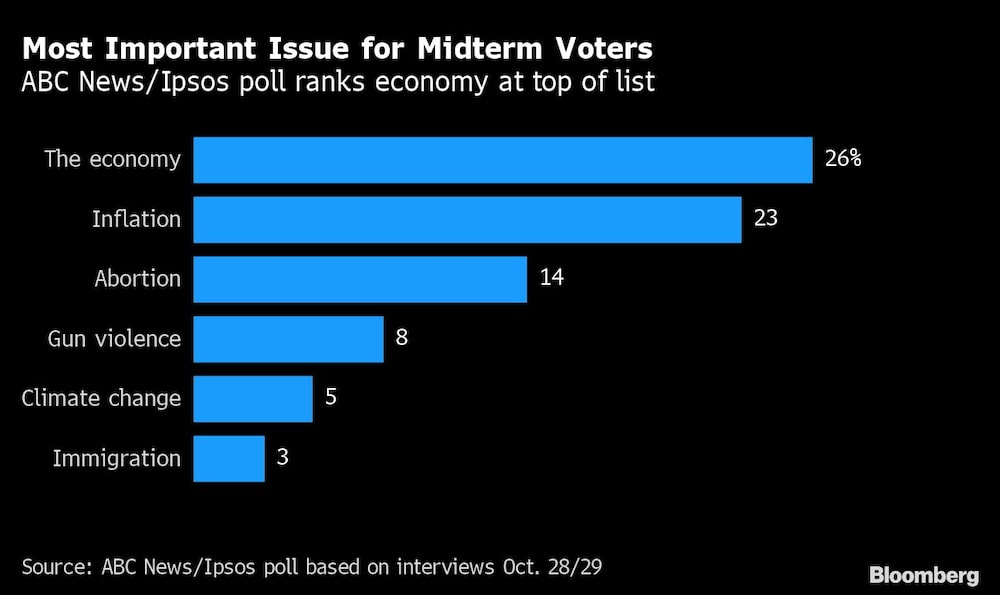

Polling suggests that hopes and fears for the economy outweigh the many other concerns, from abortion rights to immigration, that are on the public’s mind right now.

And the current economic landscape is one of extremes. Inflation — which, along with the economy in general, regularly tops the lists of voter priorities — is the highest in a generation, eating into paychecks. Republicans, who need to pick up just a handful of seats to take control of Congress, have put soaring prices front and center in their campaign as they heap blame on President Joe Biden and his party.

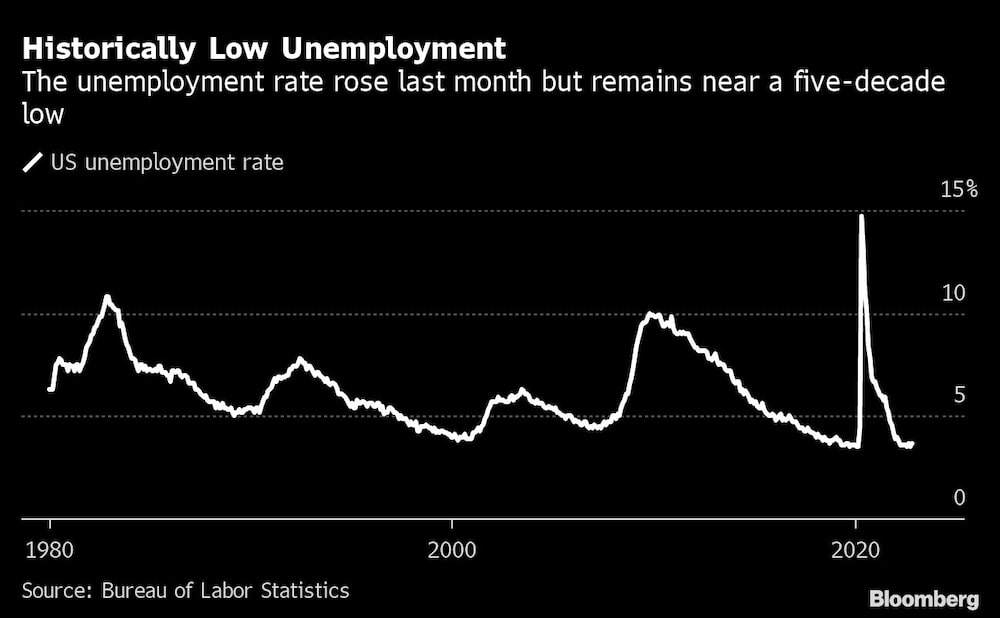

Meantime, unemployment is near its lowest in decades. For Biden’s Democrats, abundant jobs and rising wages are at the heart of their economic pitch to voters.

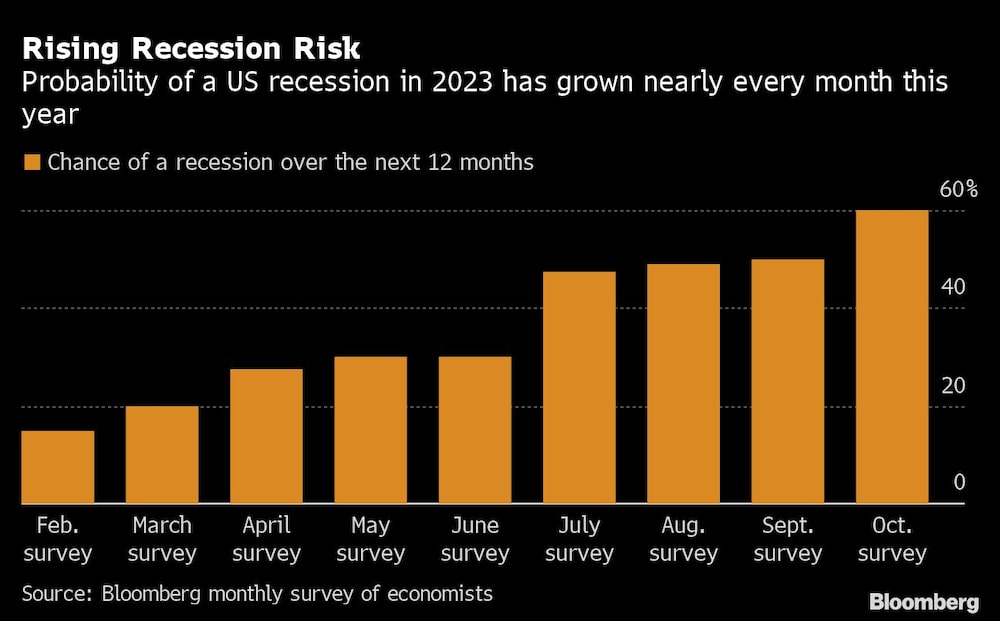

The hiring boom has been strong enough to keep consumer spending, the engine of US growth, ticking along. But the risk of a recession — most likely one triggered by the Federal Reserve’s fight against inflation — overshadows the post-election outlook. That could bring further declines in stock and housing markets, eroding the wealth of American households.

Following is an overview of the economy on the eve of election day, and the data behind each party’s argument.

The Inflation Menace

The return of inflation, largely dormant for decades, has upended US politics as well as the economy. The headline rate now stands at 8.2%, more than four times the average in the pre-Covid decade.

As Americans struggle to pay grocery and rent bills, Biden’s Democrats have sought to pin the blame on Russia’s invasion of Ukraine, which triggered a jump in commodity prices, and the aftershocks of a once-in-a-century pandemic that snarled supply chains.

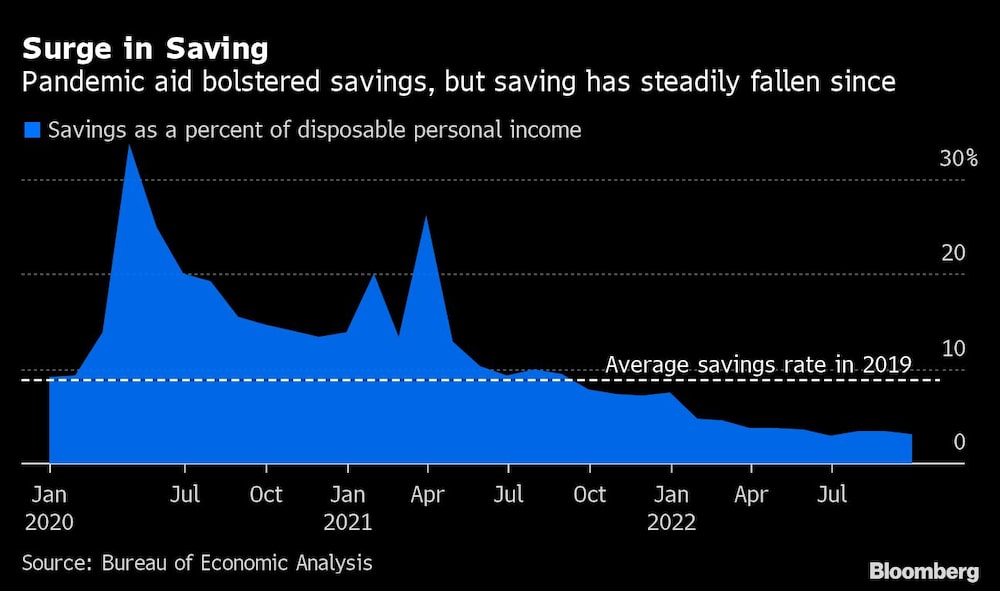

Republicans point to the $1.9 trillion American Rescue Plan, passed in early 2021 with Democratic votes, unlike prior pandemic relief packages that had bipartisan backing. It included checks for households, expanded unemployment benefits, and money for state and local governments.

“Republicans have a very strong argument in saying it’s a policy error by the Biden administration that gave us this spike in inflation,” said Douglas Holtz-Eakin, president of the American Action Forum and chief economist on President George W. Bush’s Council of Economic Advisers. “It made a huge contribution.”

Economists argue about how big that contribution is. Researchers at the San Francisco Fed estimated that fiscal support throughout the pandemic may have raised inflation by about 3 percentage points. Bloomberg Economics found that so-called “excess savings,” bolstered by the government transfers, added around 2 or 3 percentage points.

For many Americans, the most painful reminder of high inflation comes at the pump. The Russia-Ukraine war squeezed global oil markets, pushing US gasoline prices to record highs in June — and turning them into a major election issue.

Biden aides, who long ago realized that overall inflation wouldn’t ease much by November, have been hoping that a pullback in gasoline would at least partly allay voters’ anger over the rising cost of everything else. Pump prices have fallen about 25% from the June peak, though they’re still high by the standards of recent years.

The administration moved to ease the gasoline crunch by releasing some of the nation’s strategic oil reserves. It’s taken other anti-inflation measures like convening a supply-chain task force, and has considered removing tariffs on some imports from China. Still, the White House has limited tools to tame prices, which Biden’s team views as the Fed’s purview.

Jobs Aplenty

Democrats’ strongest economic talking point by far is the buoyant labor market. Less than two-and-a-half years after the pandemic pushed millions of Americans out of work, the national unemployment rate had dropped back to the lowest level in half a century. It took more than twice that long to recoup the jobs lost in the Great Recession. And even though new data out Friday showed a rise in unemployment, it also showed businesses still hiring at a faster-than-expected pace.

“Having a job is the foundation for economic security for families all across this country,” said Heather Boushey, a member of Biden’s Council of Economic Advisers. “Getting the unemployment rate down was the number one priority.”

More than half of US states have posted a record-low jobless rate at some point this year. In 17 of them, it’s below 3%. Employers are still adding plenty of jobs — and since the pandemic led many people to drop out of the labor force, requiring businesses to compete over a limited pool of workers, they’ve generally had to offer better pay and benefits.

Low-income workers have seen some of the fastest wage gains. White-collar employees have been able to leverage their enhanced bargaining power into more work-from-home days. Historically high levels of openings allowed millions of Americans to quit jobs for better pay or more enjoyable work.

That said, most wages still haven’t been able to keep up with inflation, forcing many households to lean on savings or credit cards to keep up their spending.

“You can’t pronounce a labor-market victory until inflation comes down,” said Jason Furman, a Harvard University professor and head of former President Barack Obama’s Council of Economic Advisers. Until then, “the outlook for the labor market is very much TBD.”

Adds Up to Misery?

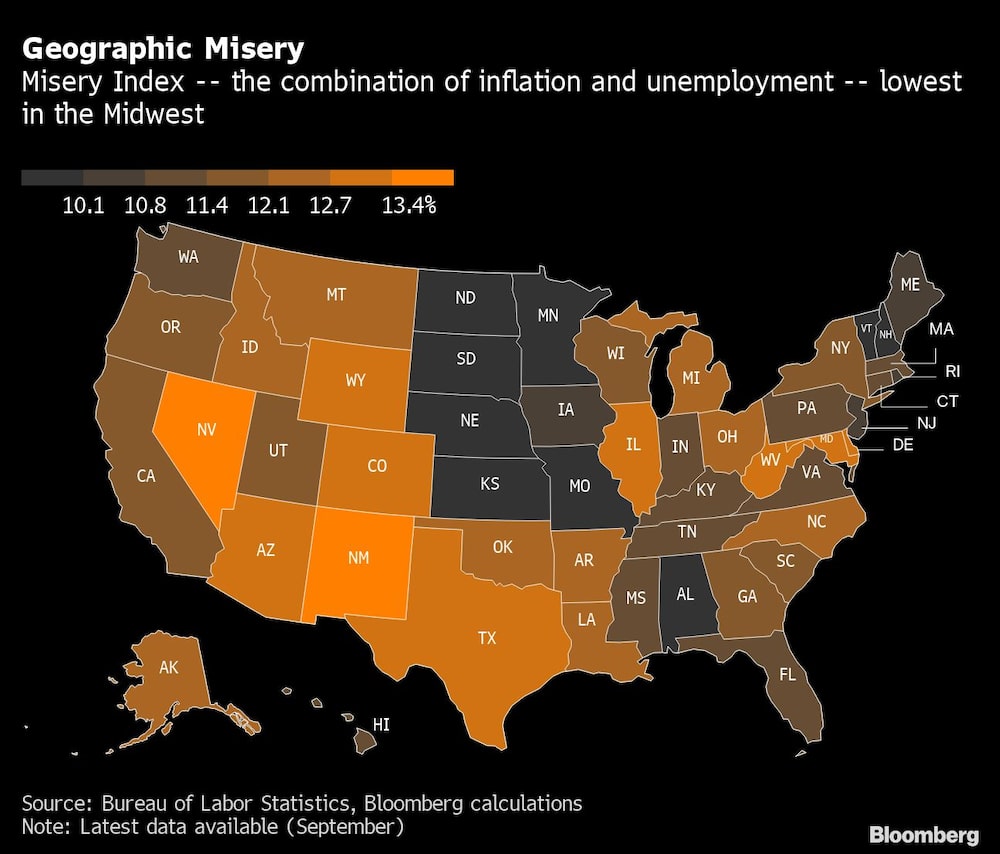

Add up the unemployment and inflation rates, and you get a measure that economists call the Misery Index. That gauge has improved since summer, but it’s still high by historical standards.

According to analysis by Bloomberg Economics, based on past voting patterns, the index’s current level points to Democrats losing 29 seats in the House of Representatives — more than enough to strip them of their majority.

In key battleground states like Georgia, Nevada and Pennsylvania, the misery index is in line with or slightly above the national reading.

Wealth Effect

The Fed’s attempt to crush inflation with higher interest rates is driving asset prices down, making many Americans poorer.

Mortgage rates have jumped to the highest levels in 20 years, stifling demand. Home prices remain exceptionally high -- protecting the main source of wealth for middle-class households, in particular -- but in many regions they’re starting to fall. The Housing Center at the American Enterprise Institute forecasts a nationwide drop of as much as 15% by the end of 2023.

What’s more, the stock market has tumbled about 20% this year, chipping away at retirement savings in 401k accounts.

These wealth effects have had a noticeable impact on sentiment, especially among wealthier households. For instance, the University of Michigan’s surveys typically show that higher-income respondents view their personal finances more favorably than those with lower incomes — but recently that dynamic has flipped.

Soft or Hard Landing

The Fed’s tightening ultimately threatens to tip the economy into a slump that would likely send unemployment back up.

Larry Summers, a former Democratic Treasury Secretary, says that taming prices may require a jobless rate of above 6% -- which would likely mean several million Americans losing their jobs. Bloomberg Economics expects the US economy to fall into recession in the second half of next year.

Biden recently conceded the risk of a ``very slight’' recession. Even mild downturns cause plenty of pain, though some economists argue that the political fallout from soaring prices is even worse than from unemployment, because the impact is felt more widely.

Causes and Consequences

Beyond the key variables of jobs, prices and growth, there are other economic issues that have featured in the election campaign.

The Biden administration is touting its plan to forgive as much as $20,000 of student debt for some borrowers, as well as measures to encourage clean energy, arguing they’ll bring long-run benefits for the economy. Republicans say both will make inflation worse.

What’s more, while the state of economy will be a key influence on which party has power in Congress, the opposite is true too.

The makeup of the legislature will determine whether Biden can enact more of his agenda, including plans to make child care and education more affordable, over the next two years –- and what kind of stimulus, if any, the US government will inject in the event of a recession.

--With assistance from Andrew Husby, Eliza Winger and Alexandre Tanzi

Read more on Bloomberg.com