Bloomberg Línea — The new government of President Luiz Inácio Lula da Silva, who takes office Sunday, January 1, has a series of challenges in the economy that should define the success or otherwise of his third term. The main one will be to adopt a responsible public spending policy and develop a new fiscal anchor to replace the current spending cap rule.

With Fernando Haddad at the Ministry of Finance, Lula will face a less favorable economic scenario than the one faced by the now former president Jair Bolsonaro in 2022. In addition to pressure to increase public spending, the trend this year is a loss of tax revenue growth and economic slowdown in Brazil and worldwide.

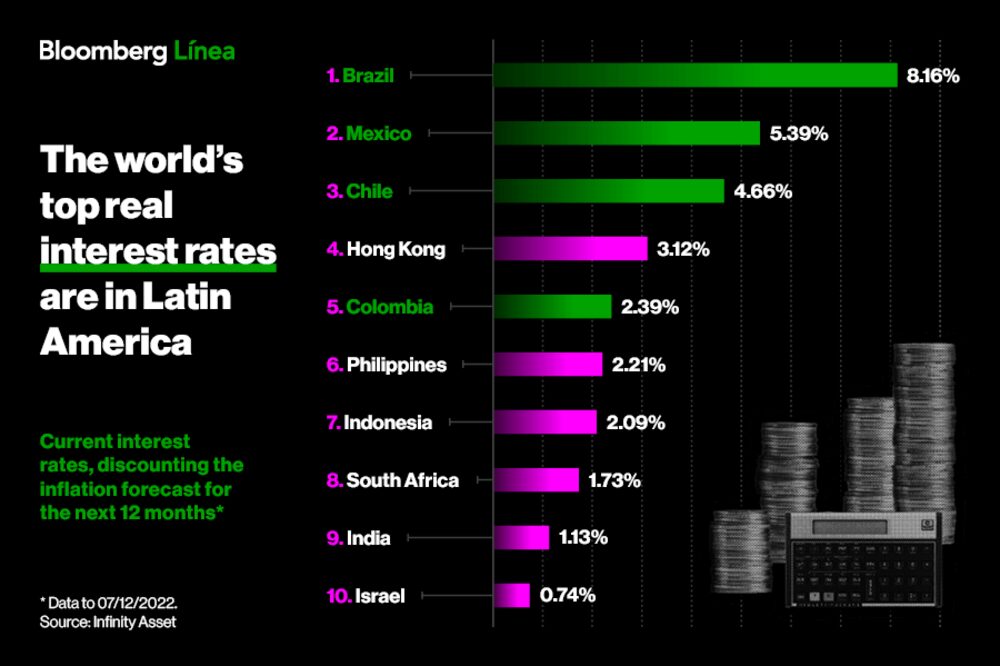

The high interest rate, currently at 13.75% per annum, increases the cost of credit and puts pressure on economic activity. The Gross Domestic Product (GDP), which should end the year with an annual expansion of around 3%, tends to slow down to 0.79%, according to financial market estimates published in the Central Bank’s Focus Bulletin.

In recent weeks, Bloomberg Línea spoke with economists and studied reports from financial institutions to assess what the outlook for the economy is under Lula’s government.

See below what are the main challenges of the new government in economic matters:

1. Balancing public accounts

The main uncertainty regarding the Lula government is the conduct of fiscal policy. Signs of an increase in public spending without compensation or clearer control in the medium and long term are the issues that most concern financial market analysts.

Uncertainty persists even after Congress approved in late December the transitional SGP, which increased the spending limit provided for in the spending ceiling rule. The PEC releases a higher value of R$ 145 billion for the ceiling and removes from the fiscal rule R$ 23 billion related to increased revenues for public investments, adding up to a total increase of R$ 178 billion by 2023.

The purpose of the measure is to allow the maintenance of the payment of the Bolsa Família social program at R$ 600 and to recompose spending for the Farmácia Popular, School Lunch and Gas Assistance programs, among other expenses.The extension of the spending ceiling will only be valid for one year, as opposed to the four years previously advocated by Lula’s team. The value was also below the more than 200 billion reais of the original proposal.

Even dehydrated, the PEC should lead to a significant increase in federal government spending, which should rise from 18.3% of GDP in 2022 to 19.4% in 2023, according to calculations by BTG economists led by chief economist Mansueto Almeida, a former secretary of the National Treasury. This is a reversal of the downward trend in spending relative to GDP in recent years.The economists estimate that the government will have to raise tax revenues to offset the increase in spending. One possibility would be to revise federal subsidies and reintroduce the federal Cide, PIS and Cofins taxes on fuel.

The taxes were reduced to zero in mid-2022 until December 31. At the end of the year, Fernando Haddad asked former Economy Minister Paulo Guedes not to extend the exoneration and said that the government would re-evaluate the case after his inauguration.

The estimate is that the return of tax collection can produce about R$ 53 billion in revenue in 12 months. The amount is insufficient to cover the increase in PEC spending and Brazil may end the year with a primary deficit of -1.2% of GDP, after reaching a surplus in 2022.

“The deterioration of the primary result, as well as the maintenance of Selic at a high level for longer, should translate into a growth of almost 5 points of GDP for gross debt, rising from 73.8% in 2022 to 78.2% in 2023″, says BTG, in a report.

Haddad has indicated that the government will work on drafting a new fiscal anchor to replace the current format of the expenditure ceiling rule, which is considered obsolete having been punctured several times in the last two years.

Although this new rule is undefined, the biggest risk is that public spending will enter an unsustainable growth path, reducing market confidence in the control of public accounts.

“The big test will be the design of the fiscal framework,” said Alessandra Ribeiro, economist and managing partner of Tendências consulting firm. “From there we will understand in which area of fiscal policy we are operating. If we make a new framework that allows a very substantial real increase in spending, we may enter a pessimistic trajectory for the Brazilian economy, with the return of macro instability.”

In the most pessimistic scenario, the trend would be upward in the country’s yield curve and the risk of a depreciation of the real against the dollar, possibly forcing the Central Bank to raise the key interest rate further to combat the pressure of the exchange rate and fiscal expansion on inflation.

Since Lula’s election in late October, the average market estimate for the Selic rate at the end of 2023 has risen from 11% to 12.25% per annum, according to the Focus bulletin.

2. Slowdown of the Brazilian and global economy

After the pandemic shock of 2020, the Brazilian economy had two consecutive years of strong recovery in 2021 and 2022. The Gross Domestic Product (GDP) advanced by 4.62% in 2021 and will close 2022 with an increase of around 3%.

For 2023, however, the outlook is for a slowdown, according to financial market economists. Itaú, for example, forecasts an expansion of 0.9% this year. Bradesco estimates growth of 1%, while Santander sees an increase of 0.8% and BTG 0.7%.The slowdown has to do with the loss of strength of the segments more linked to on-site activities that had been damaged in the pandemic, such as the service sector. In addition, maintaining the Selic rate at a high level tends to keep the cost of credit high, reducing activity in the segments most dependent on loans, such as civil construction and automobiles.

Expectations abroad also point to a slowdown in the world economy, with the risk of recession in the euro zone countries and the United States, also due to high interest rates.

In addition, maintaining the Selic rate at a high level tends to keep the cost of credit high, reducing activity in the segments most dependent on loans, such as construction and automobiles.

Abroad, the global economy is also expected to slow down, with the risk of recession in the euro zone countries and in the United States, also due to high interest rates.

In this more difficult environment for the world economy, Brazilian export sectors, such as iron ore and agribusiness, are suffering from the fall in demand and international raw material prices.

It is a more unfavorable economic scenario for Brazil and for President Lula’s government. “In his first and second terms, Lula had a very calm and very favorable global situation for a good part of his government,” said Roberto Padovani, chief economist at BV (formerly Banco Votorantim). “Now it’s the opposite situation. We had the pandemic in 2020, then a rapid recovery in the world, with growth around 6%. What we are seeing now is an adjustment process.”

Padovani points out that the expansion of public spending in a scenario of economic slowdown and possible fall in revenues tends to put more pressure on the government’s fiscal result.

In his assessment, the combination of fiscal uncertainty and weakening of the world economy tends to keep pressure on the exchange rate.

Alessandra Ribeiro, from Tendências, has a similar opinion. “Depending on the decisions we make on the economic front, we may be more or less penalized,” she says. “We have a very different external environment than in recent years, when interest rates were very low and liquidity was very high abroad. The market was less selective because the cost of money was lower than it is today. This whole context weighs positively for the Brazilian economy.”

3. Inflation

After peaking at 12.13% in April, the 12-month cumulative HICP fell to 5.90% in November.The fall in the main inflation index was influenced by the Central Bank’s monetary tightening, which raised the Selic rate to 13.75% per annum, and also by federal and state tax cuts on products such as fuel and electricity. It has also helped that the exchange rate is more under control and that commodity prices have stabilized or even fallen since mid-2022.

For 2023, the outlook is for lower inflationary pressures, but the financial market expects the IPCA to close the year at 5.23%, above the Central Bank’s target of 4.75%. The consulting firm LCA, for example, forecasts a 0.9 percentage point increase in the IPCA in 2023 due to the end of the exemption on gasoline, diesel, ethanol and natural gas.

According to LCA, uncertainty about the end of tax exemptions has led to an increase in the forecast spread for the HICP in financial markets. Increased government spending and the lack of definition on a new fiscal framework have also led to estimates of a slower slowdown in inflation.

“The possibility of faster tax cuts is one of the two main reasons why our inflation forecasts for 2023 now have an upward bias,” the consultancy says in a recent report. “The other reason is the expectation of a stronger near-term fiscal impulse stemming from the passage of the Transition SGP.”

In this environment, economists believe that the Central Bank tends to keep interest rates high for longer. Before Lula’s election, the estimate was that Copom could reduce the Selic rate in the first half of the year. Today, the assessment is that this should only happen in the second half of the year.

4. Tax reform

Tax reform has been identified for years by economists and experts as one of the most necessary legislative changes to reduce tax complexity in the country, reduce bureaucracy and increase productivity and competitiveness in Brazil.With the appointment of economist Bernard Appy to the Special Secretariat for Tax Reform at the Ministry of Finance, the government is expected to prioritize the reform. Appy is the mentor of the current tax reform proposal in Congress, PEC 45/2019.

The project foresees the replacement of federal and state taxes with a single tax called IBS (Goods and Services Tax), similar to VAT (Value Added Tax), used in several countries.Fernando Haddad, appointed Minister of Finance, has stated that tax reform will be one of the main priorities at the beginning of Lula’s government. In addition to PEC 45, another similar proposal is also pending in Congress, PEC 110.

“Appy’s placement to defend the PEC 45 project, or perhaps PEC 110, is very positive. These are reforms that, unfortunately, the Bolsonaro government, with the economic team, did not buy and did not want to move forward. We lost a lot of time with this. If we really manage to pass this broad tax reform project, we can have very positive impacts for productivity and potential GDP,” says Alessandra Ribeiro, economist and partner-director of Tendências consulting firm.

5. Maintaining reforms and legal frameworks

Since the government of Michel Temer, who assumed the presidency after the impeachment of Dilma Rousseff in 2016, Brazil has managed to pass a series of important reforms and legal milestones to increase the dynamism of the Brazilian economy.

These include the labor reform, which reduced the legal risk for companies of labor lawsuits, and the pension reform, which reduced the trajectory of pension spending, which accounts for almost half of the government’s primary spending.

Also approved were the Central Bank Independence Law, which establishes a fixed four-year term for the president of the Central Bank, interspersed with the election for president of the Republic; the Economic Freedom Law, to reduce corporate bureaucracy; and the New Foreign Exchange Framework, which consolidates the rules for foreign exchange operations.

In addition, the Legal Framework for Sanitation encouraged privatization and increased investments for public water and sewage services, one of Brazil’s bottlenecks. Almost half of the Brazilian population (or 100 million people) does not have access to a sewerage network, according to the Ministry of Regional Development (MDR).

Other recently approved reforms were also important, such as the Cabotage Framework, to facilitate maritime transport along the Brazilian coast, and the Railway Framework, which allows the construction of railroads proposed and built by private initiative.

In the assessment of Alessandra Ribeiro, economist and partner-director of Tendências, one of the challenges of the Lula government will be precisely to maintain the economic agency that stimulates the private sector, without making changes in the reforms that have worked in Brazil.Lula has said since the campaign that he intends to review some points of the labor reform, which worries the private sector. Before the law, one of the big legal costs was labor lawsuits, which plummeted after its approval.

“It is a challenge to maintain the reforms so that the country can reap all the positive effects,” says Alessandra Ribeiro. “We see here and there complicated statements, pointing to setbacks, which for the country would be a great loss, since we have not even begun to reap the benefits of all this agenda implemented since mid-2016.”

The economist also points out the importance of maintaining the agenda of innovations implemented by the Central Bank, which have not only allowed greater agility and ease for means of payment, such as Pix, but also seek to increase the competitiveness of the financial and banking system. “The preservation of this agenda is fundamental,” he says.