Bloomberg — In 2020, tech-heavy hedge fund Light Street Capital Management posted a banner year on bets including Amazon.com Inc. (AMZN) and Alibaba Group Holding Ltd (BABA).

That was the last of the good times. The firm, along with other once-high-flying stock hedge funds, is coming off a second year of losses that erased billions of dollars in clients’ wealth.

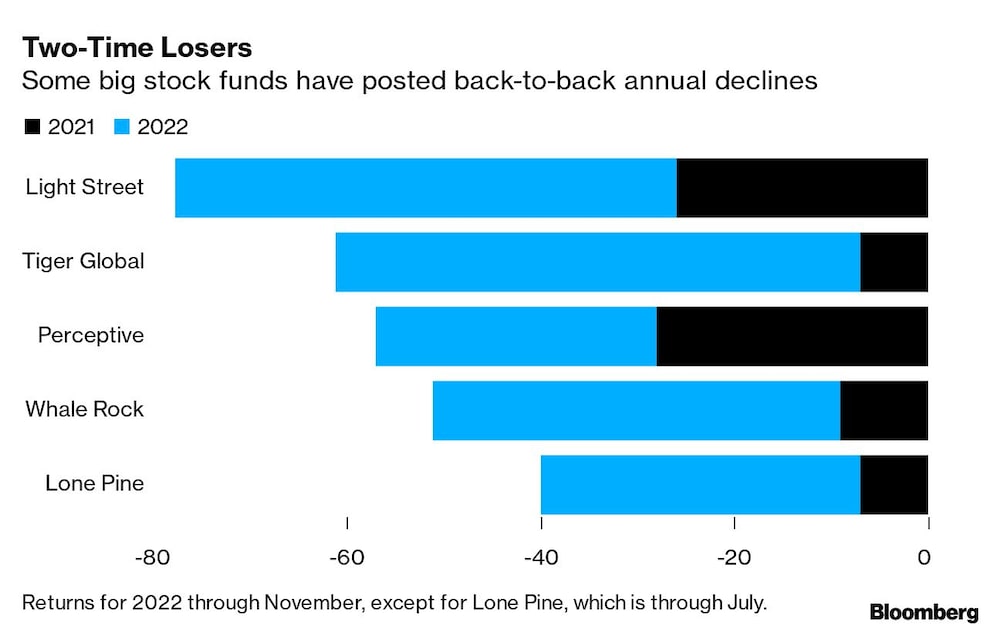

Light Street, Whale Rock Capital Management, Tiger Global Management and Perceptive Advisors each posted declines of more than 40% during the last two years, according to people familiar with the returns. Those losses could prove problematic for smaller firms, given that investors pay lower or no fees on gains until they’re made whole.

The back-to-back downswings at some stock funds created huge dollar losses for clients because many tech- or health care-focused funds minted money when companies like Facebook parent Meta Platforms Inc. (META), Tesla Inc. (TSLA) and Amicus Therapeutics Inc. (FOLD) were booming.

Yet as inflation picked up late last year, these same shares nosedived — and few funds increased their short bets to take advantage of the fall.

Chase Coleman’s Tiger Global hedge fund plummeted 57% over the past two years; in dollar terms it erased all the gains it made since the end of 2018. The firm managed about $15 billion across its hedge and long-only funds as of Sept. 30, with an additional $43 billion in private investments.

Alex Sacerdote’s Whale Rock tumbled 47% over the past two years. He now manages about $6 billion, compared with $12 billion at the end of last year.

The hardest hit is Glen Kacher’s Light Street. The firm, which oversaw about $2 billion as of the end of 2021, has lost almost two-thirds of its value over two years.

Joe Edelman’s Perceptive Advisors, which focuses on the life-sciences industry, tumbled about 49% in the same period.

Stark Contrast

The accelerating declines at many equity hedge funds this year contrast with the rest of the industry, which outperformed plunging stock and bond markets in 2022.

“If you just looked at the headlines, you would have thought it was a disastrous year for the industry,” said Jon Caplis, head of hedge fund research firm PivotalPath. “Yet our composite index is the most stable it’s been in years,” with the change in performances from month to month extremely low compared with historically large movements in the stock market.

Hedge funds, on average, fell 1% this year through November, according to an index of 1,157 funds tracked by PivotalPath. That compared with a 14% drop in the S&P 500 and a 13% tumble in the Bloomberg US Agg Index.

Some managers at stock funds that did see deep losses opted to close their doors in 2022.

Gabe Plotkin shuttered Melvin Capital Management in May after losing almost half his clients’ investments in less than two years. Some complained that he didn’t try to make back some of their money, despite collecting hefty fees for six years while posting annualized returns of 30%.

Carvana Wipeout

Online used-car seller Carvana Co. (CVNA) took a particularly brutal toll on the hedge fund industry this year. A one-time hedge fund darling, it hit a high of $376.83 in August 2021 and now trades for less than $4.

Two firms invested in Carvana that hung on through the third quarter — and marginally added to their positions then — were Clifford Sosin’s CAS Investment Partners and Spruce House Investment Management, founded by Ben Stein and Zachary Sternberg.

The car retailer made up 24% of Spruce House’s $550 million in US-traded companies in the third quarter, according to its latest regulatory filing.

CAS was Carvana’s fourth-largest shareholder at the end of the third quarter. The investment firm lost 70% this year through September, in large part because of its Carvana wager, which accounted for a quarter of its portfolio earlier in 2022.

Read more at Bloomberg.com