Bloomberg — Bank of Nova Scotia’s years-long turnaround of its Latin America-focused international unit faced a setback last quarter as the division’s lending margins contracted and non-interest revenue slipped.

The unit’s total revenue came in at C$2.42 billion ($1.86 billion) in the fiscal third quarter, the Toronto-based bank said in a statement Tuesday. While that’s up 2.4% from a year earlier, it trailed analysts’ C$2.54 billion average estimate. Overall profit also missed expectations.

Scotiabank has revamped its international business in recent years, shedding smaller and less-profitable operations while investing more in larger markets such as Chile. But in the three months through July, the unit’s net interest margin contracted by 1 basis point from the prior quarter, as interest-rate increases in the region raised the cost of deposits and customers shifted to higher-yielding term deposit products.

“They had a pretty sharp increase in deposit costs, and that overwhelmed the overall rate on interest-earning assets,” James Shanahan, an analyst at Edward Jones in St. Louis, said in an interview. “They’ve also continued to close branches in international, and there might be some drag associated with that.”

Scotiabank Chief Financial Officer Raj Viswanathan said on a call with analysts that he expected net interest margins in the international unit to remain stable in the fourth quarter and resume expansion in 2023.

Net income for the unit rose 29% from a year earlier, to C$625 million, as non-interest expenses were little changed and provisions for credit losses shrank. The unit’s loan book also expanded 12%, with gains led by business and government loans as well as mortgages.

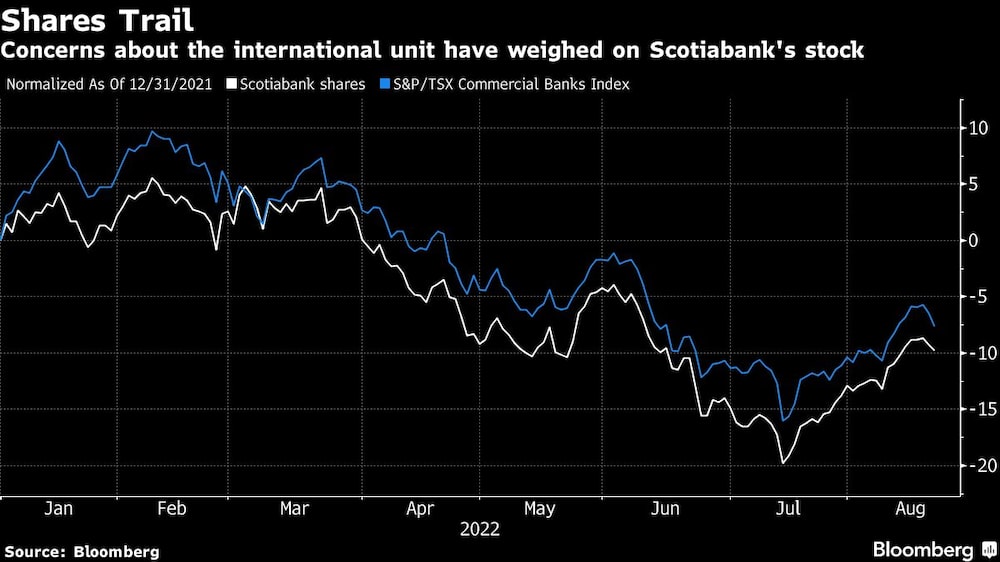

Scotiabank shares dropped 2.8% to C$78.52 at 9:39 a.m. in Toronto. They’ve fallen 12% this year, compared with an 8.5% decline for the S&P/TSX Commercial Banks Index.

Revenue in Scotiabank’s Canadian banking division rose 12% to C$3.12 billion, helped by loan growth in all categories as well as a net interest margin that swelled to 2.29% from 2.22% in the prior quarter.

Companywide, net income rose 2% to C$2.59 billion, or C$2.09 a share. Excluding some items, profit was C$2.10 a share. Analysts estimated C$2.11, on average. The bank took C$412 million in provisions for credit losses, less that the C$503.9 million than analysts had projected.

Scotiabank’s global banking and markets unit took a hit from a dearth of revenue from new share issuances and other transactions last quarter, while its trading division failed to benefit from the period’s volatile markets. Trading-related revenue fell 42% from a year earlier to C$362 million, with declines across equities, foreign exchange and interest rate and credit.

“The trading piece was softer than expected,” Shanahan said. “That’s a category that Scotia has some strength in, and they really failed to deliver on that this quarter.”