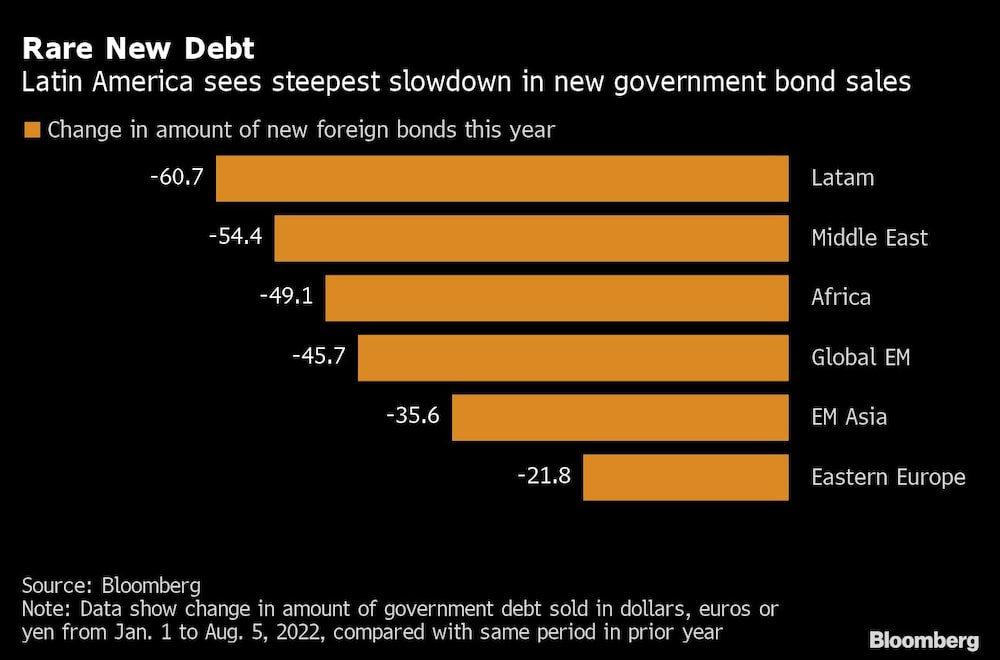

Bloomberg — It’s slim pickings for investors seeking fresh sovereign bonds from Latin America as the region’s pipeline of new foreign debt empties faster than in any other pocket of emerging markets.

Latin American governments sold just $21.6 billion worth of dollar, euro or yen-denominated debt this year as of Aug. 5, a 61% decline compared to the same period of 2021, according to data compiled by Bloomberg. It’s the steepest slowdown of any developing-market region as officials around the globe shy away from higher borrowing costs tied to the Federal Reserve and European Central Bank’s fights against inflation.

The supply of new foreign bonds around the globe has taken a major hit this year as key central banks hiked interest rates, making it more expensive for governments to tap international debt markets. Russia’s invasion of Ukraine and its impact on commodities also complicated some countries’ financing plans. Emerging-market dollar sovereign bonds handed investors losses of nearly 17% this year, compared with a 7.5% drop in US Treasuries, according to Bloomberg indexes.

“Issuance is lower across the board, but the drop may look larger in Latin America because issuance is declining from a quite high level in 2020 and 2021,” said Teresa Alves, an emerging markets strategist at Goldman Sachs Group Inc. (GS) “This increase was driven by high Covid-related spending in the region, which is now likely reverting.”

In Latin America, officials sold $55 billion in hard-currency bonds in 2021, more than any other developing-market region that year, according to data compiled by Bloomberg.

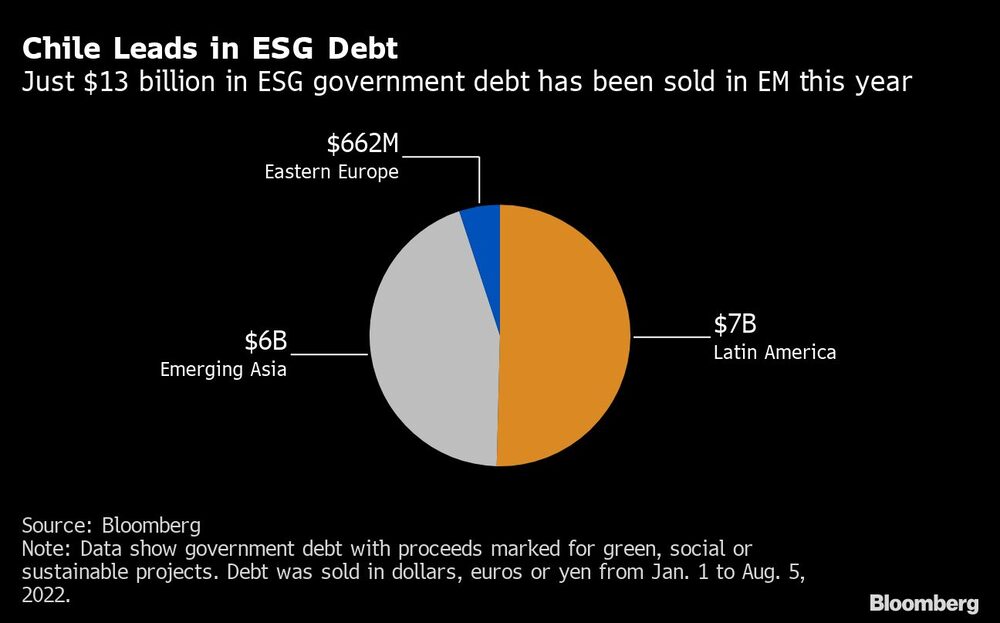

This year, though, sales have been less common. Mexico’s government has so far been the biggest bond seller in Latin America with $6.7 billion in new bonds, followed by Chile’s $6 billion in sales, according to data compiled by Bloomberg. Guatemala was the region’s most recent country to tap international debt markets, while Brazil -- which is typically a big issuer in the region -- didn’t sell bonds overseas this year.

Still, the region stands out for its sales of debt with proceeds that claim to be earmarked for environment, social or governance-related projects. All Chile and Peru’s government issuance has been marketed as ESG this year, accounting for about half of such bonds in emerging markets, data show.

JPMorgan Chase & Co. (JPM) strategists Nishant Poojary and Trang Nguyen estimate Latin American governments could offer a total of $41.9 billion in gross issuance in 2022. Emerging markets more broadly could sell over $124.2 billion, with Asia forecast to issue about $26 billion and Europe, Middle East and Africa on the hook for the remaining $56.3 billion, they said.

Another reason new issuance is drying up is that 18 countries now have bonds that trade at average spreads of more than 1,000 basis points over comparable US Treasuries -- a sign of distress.

“Argentina, Ecuador and El Salvador remain shut out of the market,” said Fitch Ratings’ Christopher Dychala and Shelly Shetty in a Tuesday note. Plus, “higher borrowing costs at a time when debt burdens have risen across the region highlight vulnerability to tightening external financing conditions.”

Governments from emerging markets around the globe have sold about $90.5 billion in dollar, euro or yen bonds this year, a 46% decline from the same period a year prior, according to Bloomberg-compiled data.

“There’s been general death of issuance,” said Giulia Pellegrini, a fund manager at Allianz Global Investors in London. “The market is effectively being closed to virtually all emerging markets. There’s been a few cases of issuance, but they have been few and far between.”