Bloomberg — Perhaps no leader who presides over an oil-producing nation has bolder plans to transition away from fossil fuels than Colombia’s Gustavo Petro.

It’s a push that, in the abstract, few would have issue with. The key question is whether Petro can execute it in a way that mitigates the financial pain inflicted on Colombians. If not, the plan’s political viability likely collapses. The answer won’t come for months or even years. But in one corner of the bond market, where traders buy and sell debt issued by Ecopetrol, the state-owned oil giant, early signs of trouble are brewing.

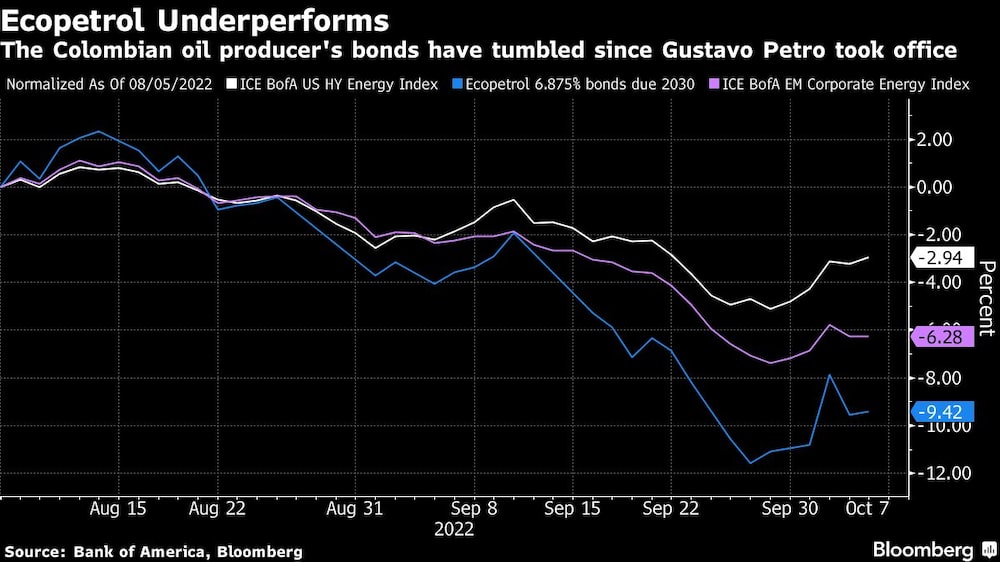

Since Petro assumed office in August as the nation’s first leftist leader, Ecopetrol’s $11 billion of dollar bonds have lost almost 8%, more than double the average decline among companies in Bank of America Corp.’s US High Yield Energy Index. Bondholders’ problems, of course, aren’t exactly the same as those of everyday people. In this case, though, the market rout could very well portend broader economic pain in a country that still gets more than half of all export revenue from oil and coal.

“It has to be a really slow process -- you can’t do it overnight,” said Jaimin Patel, a senior credit analyst at Bloomberg Intelligence. “The biggest concern is production will start leveling off, declining over a period of time if the government implements its plan.”

A representative for Colombia’s Mines and Energy Ministry said that the government’s energy transition plan includes a leading role for Ecopetrol.

The “priority is to intensify the production of renewable energies and accelerate the fair, safe and gradual energy transition in the country,” the spokesperson said.

A representative for Ecopetrol declined to comment. The company will hold an extraordinary meeting Oct. 24 to elect new board members, according to a regulatory filing.

Of course, rising US interest rates and recession worries have dented fixed-income assets broadly, especially longer duration debt, riskier speculative-grade credits and bonds from developing-nation economies perceived to be more susceptible to a global economic downturn.

But even compared to other emerging-market oil companies, Ecopetrol’s bond rout stands apart, outpacing the 6.6% slump in BofA’s Emerging Markets Corporate Plus Energy Index since Petro was sworn in.

While Petro has said that plans to phase out the economy’s dependence on oil and coal will take roughly a dozen years, money managers are nonetheless wary now.

“Ecopetrol is too important for Colombia. Oil is 40% of exports, it’s 15% of fiscal revenue and 30% of foreign investment,” said Daniel Guardiola, an analyst at Banco BTG Pactual. “The sector is literally too big to derail.”

In addition to halting new exploration licenses, in his first day in office Petro followed through on a campaign pledge by sending legislation to congress boosting taxes on energy exports. His government has also been clear that it intends to outlaw hydraulic fracturing, or fracking, which requires copious amounts of water and has been connected to earthquakes. Ecopetrol scrapped two such pilot projects as a result.

“As Petro starts to disclose more and more of his plans early on, it continues to create a fair amount of uncertainty in investors’ minds as to what the future of this company is,” said Jorge Ordonez, a corporate-credit strategist at BBVA Securities.

‘Juicy Yield’

Ordonez likes Ecopetrol’s shorter-term bonds given the government’s commitment to respect exploration and production contracts already in place.

Yields on the company’s $1.2 billion of notes due January 2025 have climbed to 7.09%, according to Trace data. The bonds are rated Baa3 by Moody’s Investors Service, and BB+ by S&P Global Ratings and Fitch Ratings, in line with the sovereign.

“It’s a very juicy yield,” said Ordonez. “I’m definitely a buyer” in the front end of the bond curve, he said, adding that Ecopetrol is “a good company in the wrong zip code.”

Even before Petro was elected, Ecopetrol had committed to reducing net carbon emissions to zero by 2050, part of a global push by oil companies to limit their climate-change footprint.

But with the war in Ukraine disrupting international energy markets and Europe facing potential shortages this winter, pressure to keep the lights on has taken precedence. While few question the need for a long-term transition, some market watchers say that Ecopetrol is at risk of missing out on a lucrative opportunity.

Petro’s plan “in many ways carries significant signal effect for the region,” said Henning Gloystein, director of energy, climate and resources at Eurasia Group. “But he needs to be really careful not to turn that signal character into a red-flash warning. Colombia has an important role to play in helping Europe phase out Russian fossil fuels. This is a strategic opportunity for Colombia to improve its revenues and geopolitical ties with important partners.”

Read more on Bloomberg.com