Bloomberg — Distressed investors are finding ample opportunity in the riskiest emerging debt markets, which have few major bonds maturing in the year ahead.

Only a tiny portion of distressed sovereign bonds from non-defaulted emerging markets are scheduled to mature next year, according to data compiled by Bloomberg. That gives money managers the chance to cash in on the high-yielding notes, with relatively few looming 2023 principal payments to worry about.

“There are plenty of non-defaulted sovereigns with highly elevated spreads, yet few of these sovereigns with elevated spreads face funding cliffs in 2023,” said Gabriel Sterne, head of global emerging-markets research at Oxford Economics. “The discerning investor may be able to profit from some hefty coupons before default occurs.”

While coupon payments can also ramp up default risk for a country in crisis, the calendar is thin for larger principal obligations.

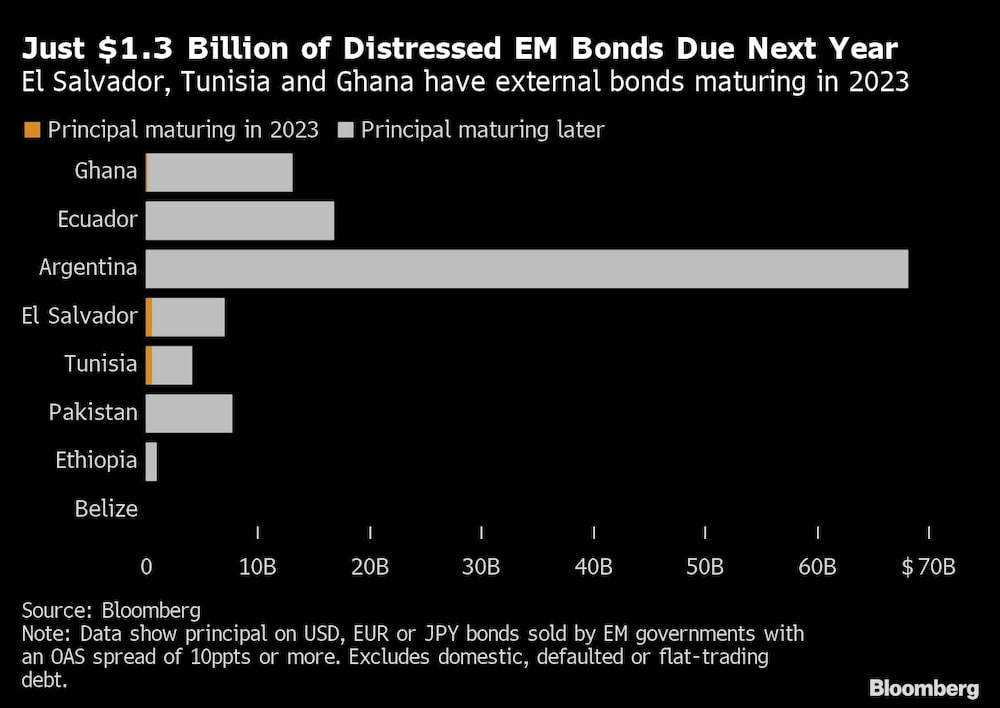

El Salvador is just weeks away from a $604 million bond maturity, and Ghana has already announced plans for a restructuring that could change the picture for a $149 million bond due in August. Tunisia, which recently struck a deal with the International Monetary Fund, is on the hook to pay holders of a $500 million note in October.

All together, there’s only about $1.3 billion in principal of the high-risk debt due next year — a small part of the roughly $118 billion in total sovereign bonds from non-defaulted emerging markets that yield an average of at least 10 percentage points more than US Treasuries, according to data compiled by Bloomberg.

That leaves Wall Street to focus on its bullish expectation that peaks in global inflation and major central-bank policy rates next year trigger a comeback after 2022′s record-setting losses. A key Bloomberg gage of emerging-market sovereign dollar bonds plunged almost 16% this year, on course for its worst annual loss since records begin two decades ago.

Such depressed bond prices can carry potential for investors who expect governments to manage their debt loads — or at least come up with attractive restructuring conditions.

“Distressed countries present interesting opportunities,” according to Gustavo Medeiros, a money manager at Ashmore Group Plc in London. The average recovery value on sovereign debt restructurings is about 59 cents on the dollar, while nations rated C or lower tend to trade at an average of 30 cents or less, he wrote in a note.

Recovery values are core to discussions among holders of defaulted bonds from Sri Lanka and Zambia, who are already looking to negotiate with government officials for a remedy. Ghana’s creditors, meantime, are still waiting for clearer plans on a restructuring the country’s external debt.

The defaults of Russia and Belarus, meantime, are much more complicated as the war in Ukraine continues and sanctions remain.

For some, though, safer options in emerging markets are more alluring. Latin America has been touted as a favorite by Bluebay Asset Management, while others say developing Asian bonds are poised to bounce back.

“We would caution investors against following this siren call of high yield and low bond prices,” said Lupin Rahman, global head of emerging-market sovereign credit at Pimco in London. “There is a lot of risk premium to be harvested in very safe emerging market credits.”

What to Watch

- China’s commercial banks may trim their quotes for five-year loan prime rates, throwing more weight behind the government’s efforts to stabilize the property market, according to Bloomberg Economics.

- Hungary’s central bank will release its monetary-policy decision on Tuesday as concerns mount over accelerating inflation and risk of an economic crisis.

- Mexico will post retail-sale figures and activity numbers for October.

- In Chile, November industrial production and retail sales are likely to add evidence that activity is falling toward sustainable levels after pandemic-related stimulus measures propelled it above potential, according to Bloomberg Economics.

- Bank Indonesia is expected to release its monetary policy decision on Thursday.

- Bloomberg Economics expects Turkey’s central bank to hold its policy rate at 9% as it has already answered the political leadership’s call for single-digit rates one month ahead of schedule.

--With assistance from Maria Elena Vizcaino and Srinivasan Sivabalan

Read more on Bloomberg.com