For all the talk of populism, Chile’s new left-wing government says it will pull off something no other major emerging market will achieve this year: a near-balanced budget.

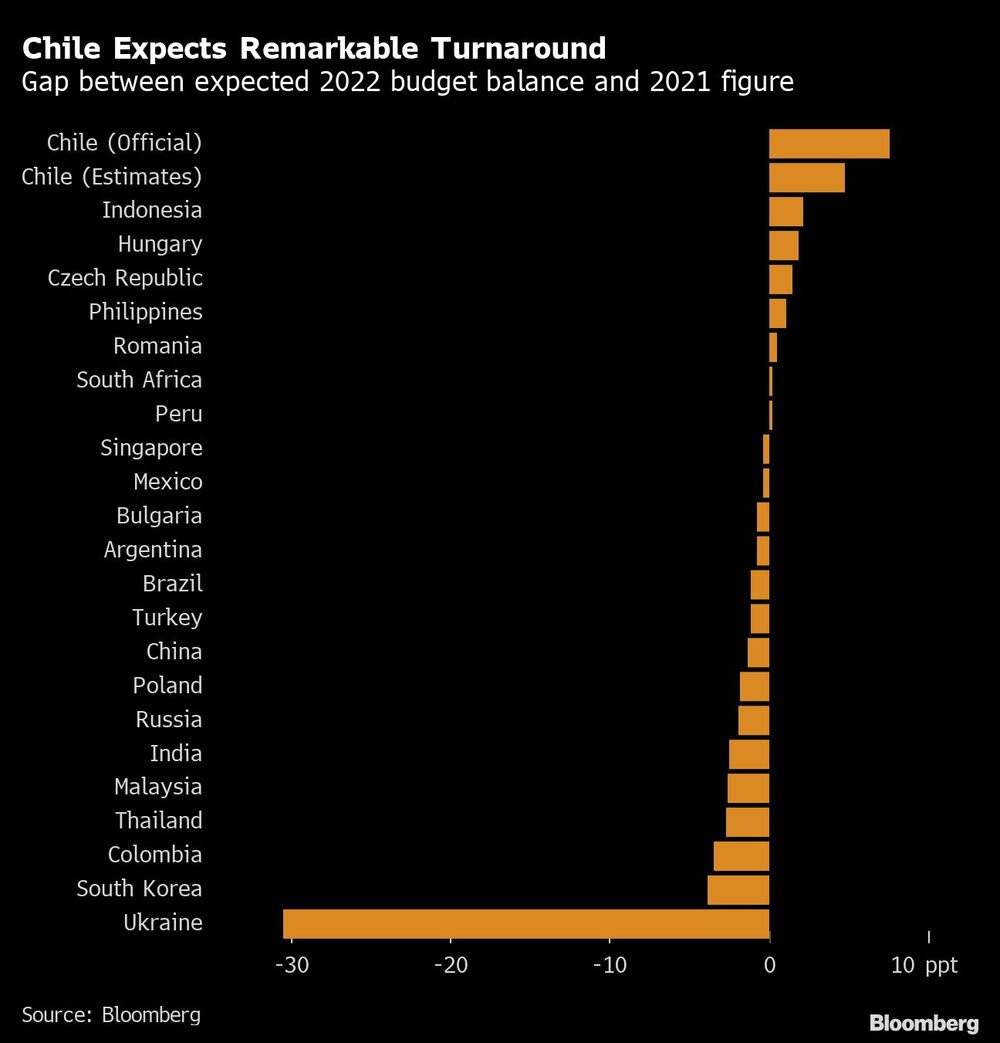

The latest forecast from the country’s budget office is for a full-year deficit worth 0.1% of gross domestic product, down from a whopping 7.7% in 2021 and 7.3% the year before. Analysts are skeptical, but even they see the shortfall dropping to 2.95%.

None of the other 22 emerging-market economies in Bloomberg’s EM currency basket is expected to trim their deficit by more than 2.1% of GDP, and in most cases, it will widen. Chile’s shortfall is tumbling as tax revenue soars with the fastest inflation in almost three decades, record lithium prices and still high copper prices. More remarkably, Finance Minister Mario Marcel is planning to slash spending by 24% for the full year, even more than the 22% the former government had forecasted in its budget for 2022.

The narrowing of the deficit isn’t just of academic interest. Chile needs to slash domestic demand to reduce the current-account deficit that reached a record 8.5% of GDP in the second quarter, undermining the peso. Marcel is doing his bit, easing pressure on the central bank to hike interest rates further.

Still, the budget surprise may prove a one-off as neither soaring taxes nor strict austerity are likely to endure.

Chileans will decide on Sunday whether to approve a new constitution. If approved, it would imply a massive increase in government spending. Fiscal outlay might have to increase between 9% and 14% on average over the next 10 years, according to a study published by the business-friendly lobby group Centro de Estudios Públicos, whose authors include former finance minister Rodrigo Valdes and former central bank chief Rodrigo Vergara.

Spending on a social safety net, health and education would all increase, but there would also be one-off costs for setting up the new institutions required by the charter. Even without a new constitution, spending is likely to increase as Chileans demand a bigger state and better services.

“New constitution, old constitution, different constitution, that train has left the station and it won’t come back,” said Alberto Ramos, chief Latin American economist at Goldman Sachs Group Inc. Fiscal spending is set to jump.

NOTE: Sebastian Boyd writes for Bloomberg’s Markets Live blog. The observations he makes are his own and not intended as investment advice. For more markets commentary, see the MLIV blog

Read more at Bloomberg.com