A roundup of Wednesday’s stock market results from across the region

🥇 Chile’s IPSA recovers after Tuesday’s rout:

The volatility seen in the US markets on Wednesday was mirrored in Latin America’s stock markets, which oscillated between losses and gains after the Fed’s decision to raise interest rates by 75 basis points.

However, Chile’s IPSA (IPSA) rebounded and recovered part of the losses of Tuesday, when it saw its sharpest loss since December.

The performance of the real estate, information technology and materials sectors contributed to the gains. Shares of Parque Arauco (PARAUCO) and Cencosud (CENCOSHO) were among the day’s highest climbers after closing Tuesday with some of the sharpest losses.

Investors were also enthused by the announcement by Health Minister Ximena Aguilera of the abolition of the mobility pass requirement and the mandatory use of masks., measures imposed more than two years ago to curb the spread of Covid-19.

📉 A bad day for Argentina, Brazil and Mexico’s bourses:

Argentina’s stock market saw the sharpest drop in Latin America, with the Merval (MERVAL) index dragged down by shares of Central Puerto (CEPU), YPF (YPFD) and Cresud (CRES).

“As much as we talk about the local market, all the attention of the day was focused on the Federal Reserve and Powell. Argentine stocks also showed declines throughout the day, which were influenced by the negative performance of the benchmark market,” Javier Rava, director of Rava Bursátil, ssaid in a note.

Brazil (IBOV) and Mexico’s S&P/BMV IPC (MEXBOL) also closed lower.

🗽 On Wall Street:

Stocks saw some crazy gyrations, with traders overwhelmed by the many headlines that followed the Federal Reserve decision and ended up signaling at least one thing: policy will remain aggressively tight -- making the odds of a soft landing look elusive.

The S&P 500 extended its plunge from a January record to more than 20%. The gauge whipsawed after the Fed announcement, climbing 1.3% at one point. Two-year US yields topped 4% for the first time since 2007. Another key portion of the Treasury curve inverted, with 10-year rates exceeding those on 30-year bonds in a time-tested harbinger of a recession. The dollar rallied.

The S&P 500 dropped 1.71%, the Dow Jones Industrial Average 1.70%. and the Nasdaq Composite (CCMPDL) 1.79%.

Jerome Powell vowed officials would crush inflation after lifting rates by 75 basis points for a third straight time and signaling even more aggressive hikes than investors had envisioned. He said the main message was that officials were “strongly resolved” to bring inflation down to the Fed’s 2% goal and added that “we will keep at it until the job is done.” The phrase invoked the title of former Fed chief Paul Volcker’s memoir “Keeping at It.”

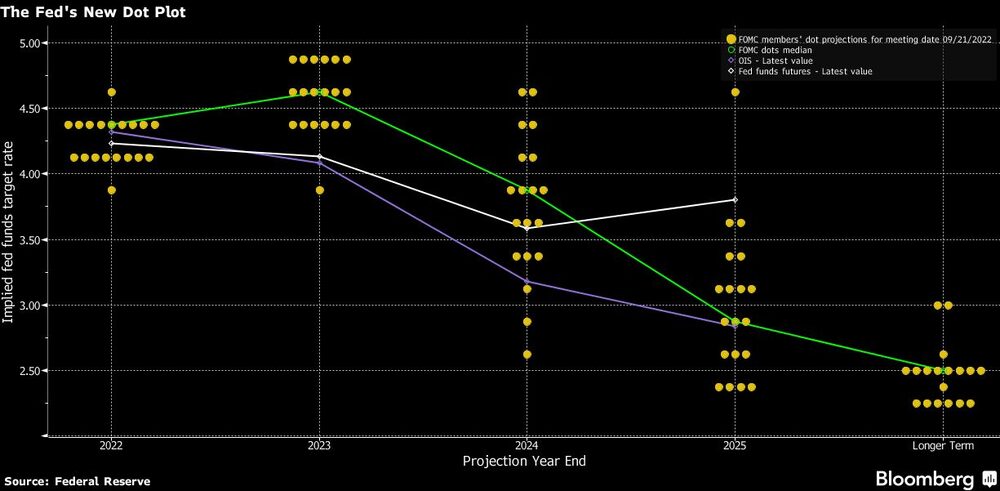

Officials forecast that rates would reach 4.4% by the end of this year and 4.6% in 2023, a more hawkish shift in their so-called dot plot than expected. That implies a fourth-straight 75-basis-point hike could be on the table for the next gathering in November -- about a week before the US midterm elections.

“Jerome Powell almost channeled his inner Paul Volcker today, talking about the forceful and rapid steps the Fed has taken, and is likely to continue taking, as it attempts to stamp out painful inflation pressures and ward off an even worse scenario later down the line,” said Seema Shah, chief global strategist at Principal Global Investors. “With the new rate projections, the Fed is engineering a hard landing -- a soft landing is almost out of the question.”

For his part, Rick Rieder, BlackRock’s chief investment officer of global fixed income, said: “We do think that markets, and consequently the economy, will become ‘Fed up’ with too much tightening, if growth (and employment) are tangibly slowing alongside of these tighter policy moves.”

On the currency markets, the Bloomberg Dollar Spot Index rose 0.7%, the euro fell 1.2% to $0.9847, the British pound fell 0.9% to $1.1281 and the Japanese yen was little changed at 143.88 per dollar.

🔑 The day’s key events:

Expectations around an even more aggressive monetary policy affected oil prices, while investors are also weighing Russian President Vladimir Putin’s announcements that he will renew his offensive in Ukraine.

Increases in the Fed’s benchmark rate could lead dozens of central banks, which have their meetings between this week and next week, to make a decision in that direction, raising the possibility of benchmark rates hitting global economic growth and with it oil demand.

In addition to the US central bank’s decision, the market also analyzed the report from the US Energy Information Administration, which showed that gasoline demand fell to its lowest level since February.

Crude stocks rose by 1.1 million barrels. “WTI crude appears to have solid support at the $80 level and, although the Fed appears to be positioning for a hard landing, the oil market should remain tight in the near term,” said Edward Moya, an analyst at Oanda.

🍝 For the dinner table debate:

More and more voices are joining in the opposition to integration of airlines Avianca, Fast Colombia (Viva) and Viva Air Peru (Viva Peru).

Bloomberg Línea learned Wednesday that there are already 10 companies, nine of them airlines, that have requested the Civil Aeronautics to be considered as interested third parties in the process that the authority is carrying out before deciding whether or not to grant authorization.

Among those who want to stop the deal are national and foreign companies. One of them is Ultra Air, which recently arrived in the Colombian market and has already made public its rejection of such a move.

Easy Fly, Wingo, Aerolíneas Argentinas (Colombia branch), Latam Airlines, Air Europa, Jet Smart and German carrier Lufthansa have also joined in their opposition to the deal.

Bloomberg Línea spoke with several of the airlines, which stated that they are seeking to get to know more closely the details of the process for the integration, and to have the opportunity to present their arguments against the operation because they consider it would change the rules of the market, restricting free competition and affecting consumers.

-- Carlos Rodríguez Salcedo, a content producer at Bloomberg Línea, and Rita Nazareth of Bloomberg News, contributed to this report.