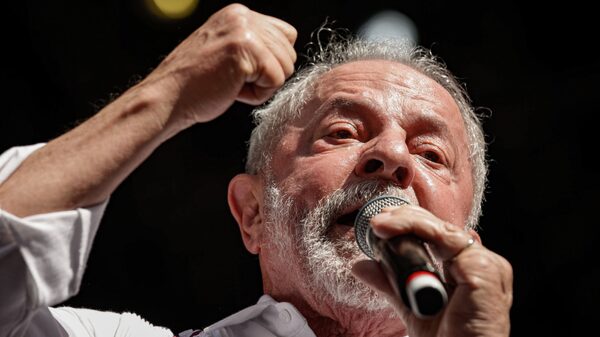

Bloomberg — Brazil’s central bank lowered its interest rate by a larger-than-expected 50 basis points and signaled more cuts of the same size are coming, cementing a dovish shift amid President Luiz Inacio Lula da Silva’s crusade for lower borrowing costs.

Policymakers led by Roberto Campos Neto lowered the Selic to 13.25% late Wednesday, as expected by only 11 of 41 analysts surveyed by Bloomberg.

Thirty others forecast a reduction of 25 basis points. The decision was split, with four board members voting for the smaller, quarter-point cut.

In an accompanying statement, policymakers wrote that the consumer price outlook has improved and that longer-term inflation expectations have fallen.

“If the scenario evolves as expected, the Committee members unanimously anticipate further reductions of the same magnitude in the next meetings,” they wrote. “It judges that this pace is appropriate to keep the necessary contractionary monetary policy for the disinflationary process.”

Brazil’s bold cut comes just days after Chile lowered rates by more than economists expected. Mexico and Peru are seen embarking on easing campaigns by year’s end. Meanwhile, developed nations that were late to fight inflation are not out of the woods yet. Last week, the Federal Reserve and the European Central Bank both left the door open for more borrowing cost hikes.

What Bloomberg Economics Says

“Lower expected and underlying inflation and less policy uncertainty finally prompted Brazil’s central bank to begin unwinding its super-tight monetary policy. As we expected, the decision wasn’t unanimous and policymakers crafted language to curb bets on larger cuts at future meetings. We’ve revised our year-end rate forecast down slightly to 11.75%.”

— Adriana Dupita, Brazil and Argentina economist

Optimistic View

Since taking office in January, Lula has pointed to high interest rates as the main obstacle to the nation’s economic prosperity, often singling out Campos Neto in his criticism. Key members of Lula’s Workers’ Party as well as some top business executives have echoed his complaints.

Just hours before Wednesday’s rate decision, Lula said that the head of the central bank “isn’t serving Brazil’s interests.”

Yet Finance Minister Fernando Haddad praised the central bank after the rate cut, saying the decision is “encouraging” and leads to an “optimistic view” on the communication between the government and the autonomous monetary authority.

“Today’s achievement was fruit of dialogue,” he said.

Senator Randolfe Rodrigues, the government leader in congress, said Campos Neto will receive a warmer welcome in the Senate during a public hearing to discuss monetary policy scheduled for Aug. 10.

“It took a while, but finally the central bank is moving according to the country’s pace,” Rodrigues said. “I have to congratulate Campos Neto for casting a decisive vote that conformed the central bank to the country’s reality.”

More Dovish

Brazil’s inflation is now below the current 3.25% target, and core price gauges are also improving. Estimates for cost-of-living increases have fallen since the government decision in June to keep future inflation targets unchanged at 3%, thus eliminating a source of investor uncertainty.

In the statement, board members wrote that monetary policy will remain restrictive until the inflation slowdown consolidates and price expectations anchor at target. Still, the decision to maintain consumer price goals gave “necessary confidence to start a gradual cycle of monetary policy easing.”

Wednesday’s decision was the first attended by new board member Gabriel Galipolo, who is Lula’s former deputy finance minister and seen by many as the central bank’s next head after Campos Neto’s term ends in 2024.

Campos Neto was the tie-breaking vote, siding with Galipolo backing a bigger reduction of 50 basis points, surprising many economist and suggesting a shift in the board’s balance of power is underway.

“The statement was more dovish than expected and with division among board members that is not common,” said Fernando Goncalves, an economist at Itau BBA. “Two directors who voted for a cut of 25 basis points will end their terms this year, and it’s likely that their replacements will make the board more dovish.”

Six Months

Going forward, the annual inflation rate will tick up in the second half of the year, central bankers wrote. At the same time, recent economic indicators back expectations that activity will slow down in coming quarters.

“The effect from rate cuts on the real economy will only be seen some six months from now,” said Igor Rocha, an economist at the Fiesp industry group.

Meanwhile, there has been progress on proposals that can improve Brazil’s fiscal outlook, as Congress is expected to resume debate on a bill to shore up public finances and another to overhaul its tax system. Lula’s economic team says the approval of such legislation will clear the way for looser monetary policy, though investors are still gauging their final impact on spending.

Unlike most past communications, central bankers refrained from mentioning the fiscal outlook.

Central bankers reiterated that the economic outlook requires serenity and moderation. They added that total size of the easing cycle will depend on factors including inflation dynamics, price expectations and the output gap.

“Financial markets were leaning more toward a cut of 25 basis points today, and there will be an adjustment,” said Natalie Victal, the chief economist at SulAmerica Investimentos. “An important point is that the board unanimously expects to continue cutting at the current pace.”

(Re-casts story, adds details from statement and economist comments starting in third paragraph)

--With assistance from Giovanna Serafim and Daniel Carvalho.

Read more on Bloomberg.com