Bloomberg Línea — Oil and gas is one of the largest sectors in Latin America and that which contributes the most foreign currency to some of the region’s economies, and which is why large-scale investors analyze not only what is happening in terms of extraction, but also the future prospects.

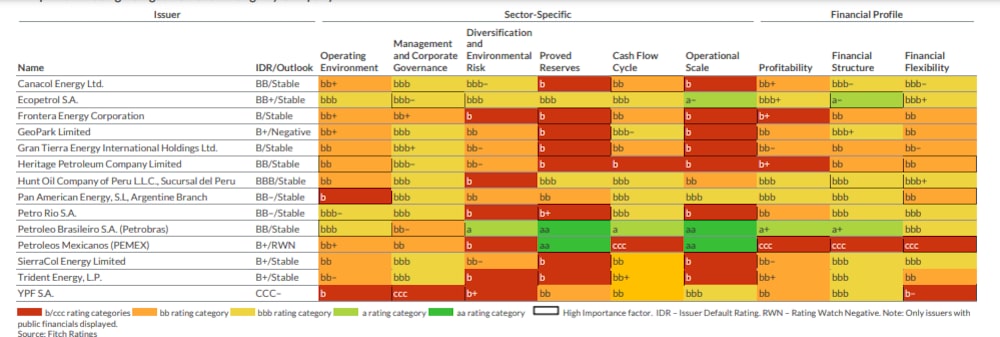

Along these lines, Fitch Ratings has published a report on the credit situation of the main oil companies in the region, from which it is also possible to analyze the context that the industry is going through.

The document shows that Fitch expects “Brazilian companies to increase their scale, materialize synergies and achieve economies of scale”. In contrast, the financial firm considered that Colombian energy and oil companies face increasing marginal costs due to the decrease in reserves.

Brazil to lead growth in the sector

After years of no significant change in production across the market, Brazilian energy and oil companies are expected to drive growth in 2023.

According to Fitch, Petróleo Brasileiro S.A.’s (Petrobras) recent divestments of non-strategic assets have created an opportunity for new low-cost producers to monetize reserves through secondary and tertiary recoveries. Petro Rio S.A. led this trend in 2022, overcoming operational hurdles in production and reserve size.

Warnings on Colombia and Mexico

Fitch warned that Colombia’s reserves are being depleted due to the effective ban on unconventional production. According to the most recent assessment by the country’s National Hydrocarbons Agency, proven crude oil reserves have a useful life of less than 7.5 years, with limited expectations of significant discoveries in the near future.

Fitch also notes that Mexico’s reserve life is estimated at nine years, but warns that “poor infrastructure and resulting inefficiencies will challenge further exploration and development, which will further strain reserve life”.

On the other hand, the rating agency maintains that Brazil’s reserve life is estimated at 11.5 years and prospective development in the equatorial margin formation, where the geological outline is promising, should increase reserves, offsetting to some extent declining trends in other countries.

Fitch Ratings warns however, for the region as a whole, that energy and environmental policies under progressive governments will continue to affect capital allocation and production costs.

YPF, with a better rating than Argentina

The Fitch report states that, for most Latin American national oil companies, management and corporate governance are of great importance, due to the “significant link” that governments have with credit ratings.

The ratings of Ecopetrol and Petrobras are at the same level as those of their respective countries. In contrast, in Mexico, Pemex’s ratings are four notches below those of the country, due to the company’s weak stand-alone credit profile and slow government action to strengthen Pemex’s capital structure and environmental policy considerations.

In Argentina, on the other hand, YPF’s ratings are one notch above the country’s due to Fitch’s view that a sovereign default event is likely to occur in the next few years. In the meantime, the oil company has good prospects given the expectations placed on the Vaca Muerta shale play.

Caution regarding oil

A report by Argentine broker Balanz Capital highlights that the combination of a surprisingly resilient economy in the United States, together with a firm stance by OPEC to maintain a limited oil supply, sustained oil prices at values close to $80 per barrel in the last month.

Meanwhile, news on the weakness of economic activity in China, together with the cooling of activity in Europe, counterbalanced and weighed on copper prices (-2% month on month).

Balanz concluded: “Despite the good activity and inflation data in the US, the tightening of the Federal Reserve’s monetary policy makes commodities more cautious. Although US economic activity seems insensitive to rate hikes, we find it hard to believe that this will be the case indefinitely. China and Europe would not provide a significant counterweight to a US slowdown. This makes us cautious, mainly on commodities linked to activity such as oil, at least until mid-2024. Gold still seems to us to be a good alternative as a hedge against negative scenarios”.