Bloomberg — Banking turmoil and recession risks are spelling trouble for the global IPO market, keeping it mired in a slump even after investors started the year thinking that the worst of the stocks rout might be over.

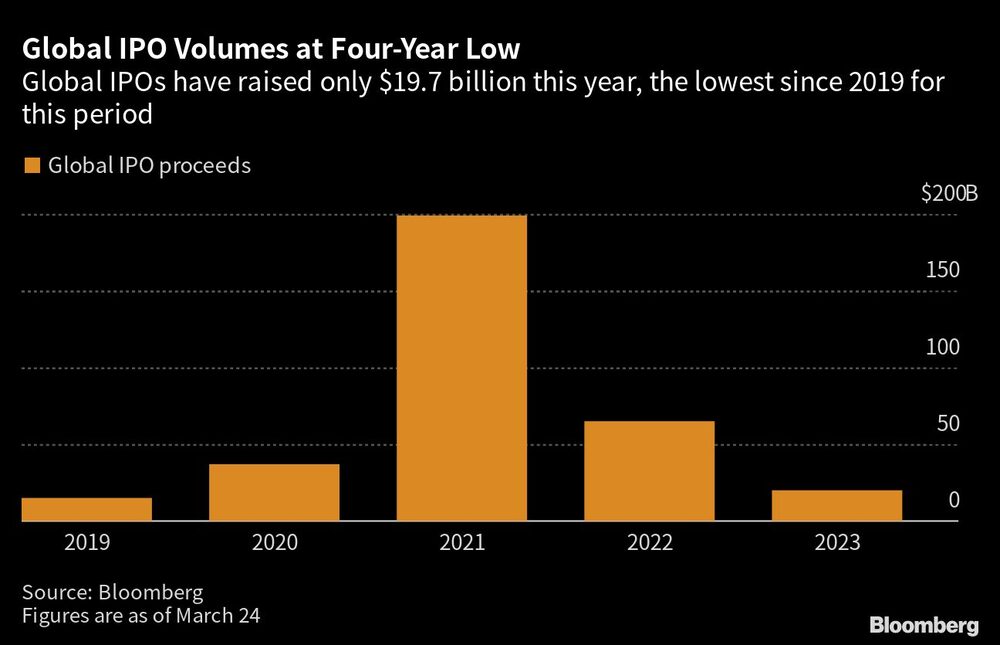

Companies have raised just $19.7 billion via initial public offerings in 2023, according to data compiled by Bloomberg. That’s down 70% year-on-year and the lowest comparable amount since 2019. The steepest fall was seen in the US, where only $3.2 billion has been raised. The subdued activity follows on from last year, when high inflation and aggressive rate hikes by central banks sapped investors’ risk appetite.

A strong equity rally at the start of 2023, driven by optimism about China’s emergence from its Covid Zero policy and smaller rate hikes, has largely fizzled out and dashed hopes for a reopening of the IPO market. Troubles in the banking sector following the collapse of some mid-sized lenders in the US, and Credit Suisse Group AG’s travails, have added to uncertainty around the path of interest rates as the US Federal Reserve works to contain inflation while avoiding more distress.

“Rates is the number one issue, and there is a clear debate around how long the tightening lasts or changes direction and at what speed,” said Udhay Furtado, co-head of ECM, Asia Pacific at Citigroup Inc. (C)

“There are a number of things people will need to see, including central bank direction, to ascertain whether it’s the second, third or fourth quarter,” he said, referring to when the IPO window might reopen. “At this point, it looks like it’s going to be back-ended.”

The stability that IPOs need has been sorely lacking, with a closely-watched volatility gauge spiking well above 20 in March following the collapse of Silicon Valley Bank and other regional US lenders. And there are signs that banking troubles are having an impact on companies’ IPO plans.

Deal on Hold

Oldenburgische Landesbank AG, a private equity-backed German bank, has paused work on a planned IPO that was expected to take place as early as May because of investors’ concerns over the health of the global banking system, Bloomberg News reported on Thursday.

“There’s still so much uncertainty in what’s going to happen at the back end of this year that I think it’s really causing investors to be quite nervous,” said Stephanie Niven, portfolio manager, global sustainable equities at Ninety One. “This feels like an uncomfortable time to be putting capital into businesses we don’t know.”

The one bright spot in equity capital markets activity has been in share sales in listed companies. Secondary offerings have fetched $76 billion this year, a 48% increase from a year ago, the data show. That includes a block trade in Japan Post Bank that could raise as much as 1.3 trillion yen ($9.9 billion), the biggest such sale in nearly two years.

Shareholders and companies were quick to sell stock to take advantage of the equities rally at the beginning of the year and secure funding in a rising-rate environment. The higher cost of debt also means that some companies have been unwinding cross-holdings to free up capital for debt repayments and other funding needs.

Large Selldowns

Fomento Economico Mexicano (FEMSAUBD) raised €3.7 billion ($4 billion) from a concurrent equity and equity-linked offering in Heineken in February, the biggest such deal in Europe, Middle East and Africa since 2004. Other large selldowns included a $2.4 billion block trade in London Stock Exchange Group Plc and Belgium offloading $2.3 billion in BNP Paribas SA stock.

Companies have also turned to convertible bonds, which allow them to borrow more cheaply, given the securities carry a call option. Firms from German food delivery company Delivery Hero SE to Chinese video entertainment company iQIYI Inc. and electric-vehicle maker Rivian Automotive Inc. have all sold the bonds. Some $6.4 billion has been raised in convertibles globally this year, data compiled by Bloomberg show.

Even after the volatility caused by the collapse of Silicon Valley Bank, bankers are optimistic that equity capital markets activity will pick up as soon as there is a window, particularly for quick, overnight follow-on transactions, while convertibles will remain an attractive funding instrument.

“We remain cautiously optimistic on the outlook for issuance activity,” Lawrence Jamieson, head of ECM for EMEA, Barclays Plc, said on March 22. “The banking contagion that started with the collapse of SVB seems more symptomatic of a confidence shock rather than a credit shock.”

“What we’ve seen over the last couple of days is markets working through the various tail risks that emerged,” he said. “If volatility also continues to dampen, this could allow for more normalised ECM activity to resume as early as next week.”

Read more on Bloomberg.com