Bloomberg — Argentina’s overseas bonds climbed to their highest in almost six months after government officials and the International Monetary Fund said they were nearing a deal to bring forward billions of dollars in disbursements from its $44 billion lending program.

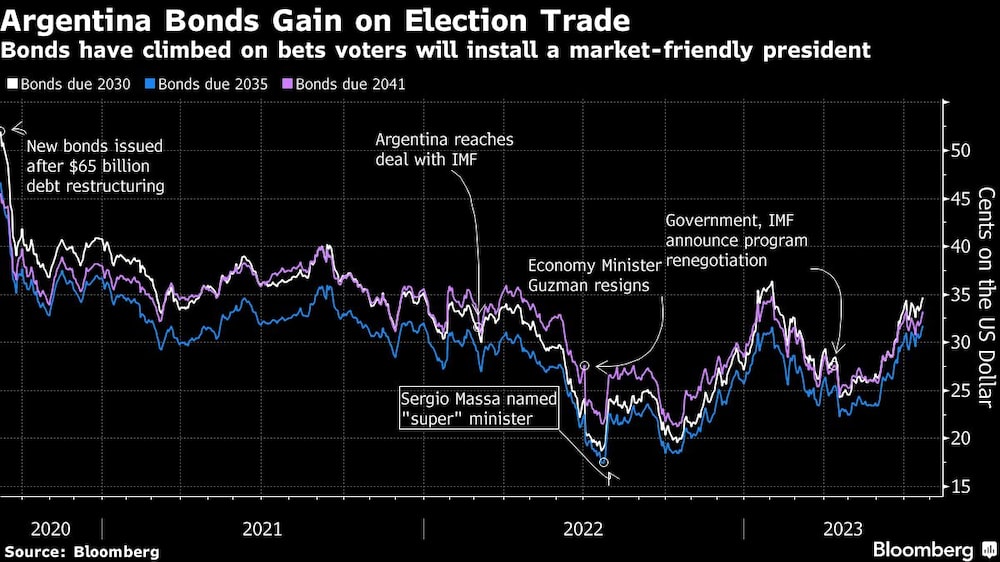

Bonds due 2030 climbed as much as 0.7 cent to nearly 35 cents on the dollar, their highest since early February. Notes due 2041 followed suit, gaining 0.8 cent to 33 cents on the dollar. Debt from the South American nation was leading gains in an index of emerging market sovereign bonds Monday.

Argentina Economy Minister Sergio Massa, who’s running for president in elections later this year, said Sunday night that the IMF would disburse funds in August and November after a staff-level agreement is reached sometime this week. Details are still scarce, with Massa saying the exact figures would be announced by the fund, which hasn’t issued a full statement on the deal.

“I was surprised they called it an agreement without a true press release from the Fund,” said Edwin Gutierrez, head of emerging-market sovereign debt at abrdn plc in London. “But the market is rallying regardless, as it sounds like the IMF is caving.”

Investors have been bidding up the bonds in recent weeks on expectations the nation would rework its IMF agreement and avoid a sharp currency devaluation before October’s elections as the central bank’s reserves sink and inflation surges past 115%.

“There’s a very big package of disbursements in August and an additional one in November,” Massa said on the C5N TV network, adding that he wants the IMF to announce the exact figures. “It’s a very significant number for Argentina.”

Earlier, the fund had said in a tweet on its Spanish-language account it had reached “understandings” on goals and parameters underlying a staff-level agreement that will then be submitted to its board for approval.

$2.6 Billion Due

Argentina is said to be publishing Monday a temporary exchange rate of 340 pesos per dollar for some agricultural exports, and will apply new tariffs on imports of goods and services.

The nation owes the IMF $2.6 billion before July 31, and it’s not clear how it’ll make the payment. In June, the government took the extraordinary step of paying part of an IMF maturity with Chinese yuan.

Concern around the IMF talks and the upcoming elections have Argentines seeking more and more hedges against a possible devaluation. The currency has tumbled 34% year to date, the worst in emerging markets. The official exchange rate trades at 271 pesos per dollar — in the black market, it’s closer to 500 per dollar.

The IMF executive board usually takes two weeks from the time of the staff-level agreement to vote on a deal, meaning it’s unclear if any disbursement will be available before July 31 to make repayment back to the Fund.

“It remains to be seen if the agreement with the IMF is closed,” Emmanual Alvarez Agis, director of the Buenos Aires-based PxQ consultancy wrote in a note. If this is only “an agreement at the staff level, but not at the board level, the risk is that the announcement will not calm volatility in the parallel exchange rate.”

--With assistance from Ignacio Olivera Doll.

Read more on Bloomberg.com