Lithium has become one of the region’s great hopes, given that the triangle formed by Argentina, Bolivia and Chile contains more than half of the world’s reserves. And Mexico also has significant reserves, but which were recently nationalized by the government.

This key component for industries such as electric vehicles has become an obsession for Elon Musk, the world’s richest man, and the owner of Tesla (TSLA) and soon-to-be owner of Twitter Inc. (TWTR), who has suggested that Tesla could branch out into lithium mining if the price of the metal does not drop.

And investors can position themselves in the lithium sector via the stock market by buying shares in companies linked to the mineral.

ETFs

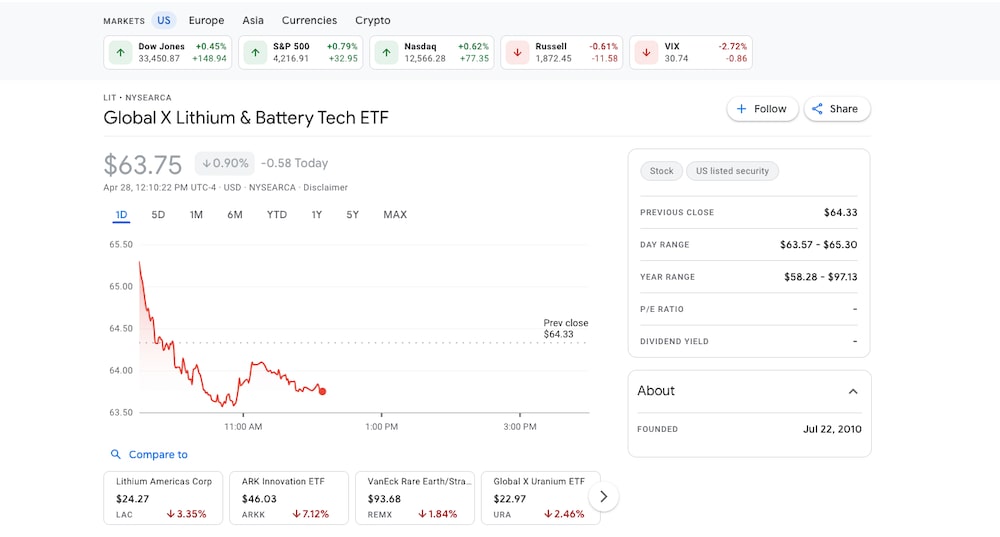

One of the most common ways of investing in the lithium industry is through an Exchange Traded Fund (ETF) called Lithium & Battery Tech (LIT), which invests in the main companies of the sector.

Of LIT’s current portfolio, 11.88% is placed in shares of U.S. company Albemarle Corporation (ALB).

In second place, this ETF has 7.32% of its portfolio invested in Tesla, and 5.73% in Japanese electronics company TDK Corporation (TDK).

And the fourth company with the greatest weight in the portfolio is Latin American, Chilean firm Sociedad Química y Minera de Chile SA (SQM), in which the ETF has 5.46% of its portfolio invested.

However, this ETF has diverged sharply from what has happened to the value of the resource itself. The fund has fallen by more than 25% over the year, while the price of lithium carbonate has risen by around 70% so far in 2022, and by more than 420% year-on-year, according to Trading Economics.

This divergence may be due to the fact that the price of the mineral began to increase in December 2020 and the related financial assets had already been increasing since March 2020, Grupo Bull Market analyst Maximiliano Suárez told Bloomberg Línea.

Individual Shares

Another way to get into the lithium industry in the hope that it will grow is by buying shares of companies that are leaders in the sector, either in lithium extraction or which are using it for their production, as is the case of Tesla. The shares that appear in the portfolio described above can be purchased with brokers operating in the world’s main markets.

“Elon Musk has another company called SolarCity, which was merged with Tesla and produces batteries for houses that store energy and are made with lithium,” according to Maximiliano Donzelli, head of research at IOL invertironline, regarding the positioning of the automaker in the industry.

However, Tesla’s shares have been suffering a year of correction, and while they are up by 28% from a year ago, they are down 27% year-to-date.

Chile’s SQM

Among the companies in Lithium & Battery Tech’s (LIT) portfolio is Chile’s Sociedad Química y Minera (SQM), not only because of its Latin American origin, but also because, unlike other companies, it has shown significant growth so far this year, with its share price having advanced 43% on Wall Street and more than 41% on the Santiago Stock Exchange so far this year.

South Korea’s Posco

And outside of the companies in LIT’s portfolio is South Korea’s Posco, and which has been attracting investor interest. The company is the world’s fourth largest steel producer and a key supplier to the automotive industry, and which has begun to move into lithium.

Donzelli highlighted Posco shares as “oriented to an investor with an aggressive long-term profile and in search of opportunities”.

“This is an iron producer, which recently announced plans to build a factory to extract lithium hydroxide for electric car batteries,” Donzelli added. “The factory is expected to have a production capacity of 43,000 tons and be completed by 2023″. For international investors, Posco stock can be bought and sold on Wall Street.

A Resource With a Future

Arturo Frei, general manager of Renta4, explained to Bloomberg Línea that the price of SQM-B had reached a maximum on April 20, and that the following day the stock showed an adjustment, following a publication in the Wall Street Journal that made reference to a new method for obtaining lithium that would improve the yield from a range of 40% to 50% to a range of 75% to 90%.

Frei added that the latter should not have a negative effect on the value of the companies however, since “it is only an incipient development”, due to the fact that the rise in the price of lithium, due to the abrupt growth in demand, is leading to a search for more efficient ways of obtaining it.

“The process is currently only working in the laboratory, and we believe that it is still too early to implement it on a large scale,” Frei said.

Frei said that, days before that publication of that article, Elon Musk had pointed out that the price of lithium was reaching levels that are too high and which are unsustainable.

“These statements only show his concern about obtaining lithium at an accessible price, since it is the fundamental raw material for manufacturing lithium batteries, and which are necessary for electric vehicles, and the main component for his cars,” Freid said.

Likewise, Donzelli added that, over the last few years, the emergence of electric vehicles has driven strong growth in lithium demand. “Already in 2018, 77% of the total demand for lithium batteries was for electric mobility. Looking ahead to 2030, it is estimated that this percentage could even grow to 89%,” he said.

The number of governments that have implemented incentives for the production and consumption of electric vehicles in recent times is also growing. Between 2014 and 2019, the market share of electric cars in the automotive market has multiplied more than six-fold, and which has also led to the increased production of lithium batteries.

‘Complex and Unpredictable’

Diego Polini, an analyst and president of Argentina Crossing, said the lithium market “is extremely complex and much less predictable than that of other minerals, such as gold or silver”.

Investors who position themselves in the lithium sector must look at prices with a two-to-three-year horizon.

“When you look at indices such as LIT, you will find very strong increases over the last two years,” he said.

Concerning the fall of this ETF, decoupled from what happened with the price of lithium itself, Paolini said: “Probably, what is clear is that the increase in market risk at all levels has led holders of lithium companies to execute orders to capitalize on the incredible gains in the sector, and perhaps reposition themselves in others that have had greater relative declines”.

Finally, he noted that although spot lithium, as well as graphite, another key component for batteries, is trending upwards, “the market is not considering that today’s prices can be sustained in the longer term”.

Translated from the Spanish by Adam Critchley