Bloomberg — A messy leadership battle at Petrobras (PETR4), Latin America’s biggest oil producer, is setting the stage for Brazil’s contentious presidential campaign and highlighting the complex tensions between the company’s pursuit of profits and its role as a tool of populist policy.

Since the weekend, President Jair Bolsonaro’s choices for chief executive officer and chairman have abruptly pulled out in a public relations fiasco. The fact that Bolsonaro is changing management so late in his term underscores Petrobras’s political importance at a time when voters blame him for high pump prices, made worse by Russia’s invasion of Ukraine.

The election has put in doubt Petrobras’s business model of market-based prices and cost control that has delivered record profits. Bolsonaro, a social conservative who was elected with support from the business community, has gone back and forth between calls for price intervention and outright privatization, signaling an uncertain future even if he comes from behind to win. Former president Luiz Inacio Lula da Silva, the frontrunner ahead of October elections, says he will rip up market-based pricing and once again make Petrobras a job creator and driver of national development.

“Volatility in Petrobras’s leadership is foreshadowing the volatility Brazil will see during the presidential campaign and after,” said Schreiner Parker, the head of Latin America of Rystad Energy, a consultancy. “The idea of a long-term experienced executive helming Petrobras, rather than a political ally, seems distant in either a Lula or Bolsonaro presidency.”

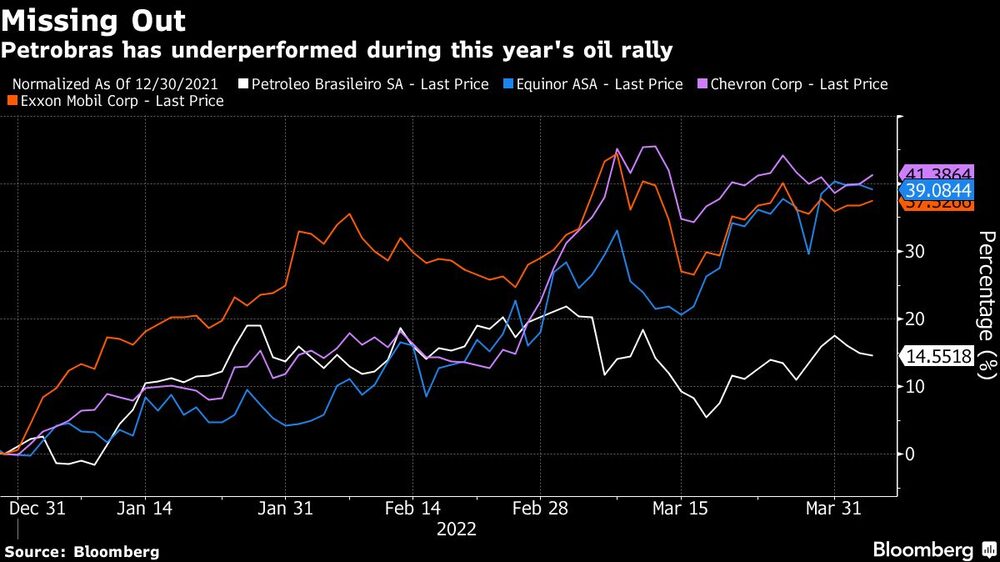

Petrobras is up 15% this year, underperforming other oil majors on concerns about political interference in fuel prices.

Help Wanted

Bolsonaro is having trouble finding a CEO after economist Adriano Pires withdrew. Pires at first accepted but then said he couldn’t unwind his consulting business fast enough. There was also speculation about conflicts of interest related to years of consulting for private oil and gas companies.

One candidate is a secretary from the Economy Ministry, Caio Paes de Andrade, said two people with knowledge of the matter who asked for anonymity because the discussion isn’t public.

They said Andrade was recommended by Economy Minister Paulo Guedes. Brazil’s economy czar has been trying to keep a distance from Petrobras’s turmoil, but his candidate is seen as a good solution because he wouldn’t face any conflict of interest and Bolsonaro is fond of him, the people said. Andrade came to government in 2019 after years in the private sector in areas such as information technology and real estate.

‘National Battle’

Whoever takes over Petrobras will face trial by fire on the campaign trail. Lula has been hammering Bolsonaro over high fuel prices, and oil policy is becoming the most populist part of a campaign that otherwise focuses on his history as a relative moderate.

“Petrobras needs to turn into a national battle,” Lula said last week at an oil union event, where he was accompanied by a former Petrobras chief executive and head of exploration. “The trucker who can’t fill his tank anymore needs to know that this fight is for him.”

Still, Petrobras’s robust dividend payments -- resulting from years of debt reduction, cost cuts and divestments -- have helped to partially shield the stock from politics. JPMorgan Chase & Co. said investors should look past the “CEO-saga” news flow and focus on the firm’s strong cash generation and the fact that shares continue to trade at a discount to peers.

“We would be buyers on likely weakness,” analyst Rodolfo Angele wrote in a recent report.