Bloomberg — Offshore investors are putting money to work in Brazil’s battered equity market as they rush for exposure to commodity producers at depressed valuations.

Non-residents added about 7.8 billion reais ($1.4 billion) to Brazilian stocks last week, the biggest weekly net amount in a year, and more buying continued on Monday, according to exchange data compiled by Bloomberg.

One of the world’s worst-performing equity indexes last year, the Ibovespa benchmark gauge of 93 stocks trades at about 8 times forward earnings, the lowest in a decade. That compares with multiples of about 20 times for the S&P500 and 12 times for the FTSE 100.

At such low levels, Brazil stocks are well positioned for a rebound, analysts said.

“There is little downside left, little disappointment left,” said Emy Shayo, the head of equity strategy for Latin America at JPMorgan Chase & Co.

Foreign inflows come after Brazilians pulled money off from local funds last month, rotating away from equities toward fixed-income products and contributing to further selling -- and further cheapness. Local Brazilian equity funds saw 3.4 billion reais in withdrawals in December, according to capital-markets association Anbima.

“Valuations are being pushed to attractive levels” as domestic funds see redemptions, said Malcolm Dorson, a portfolio manager at Mirae Asset Global Investments LLC in New York.

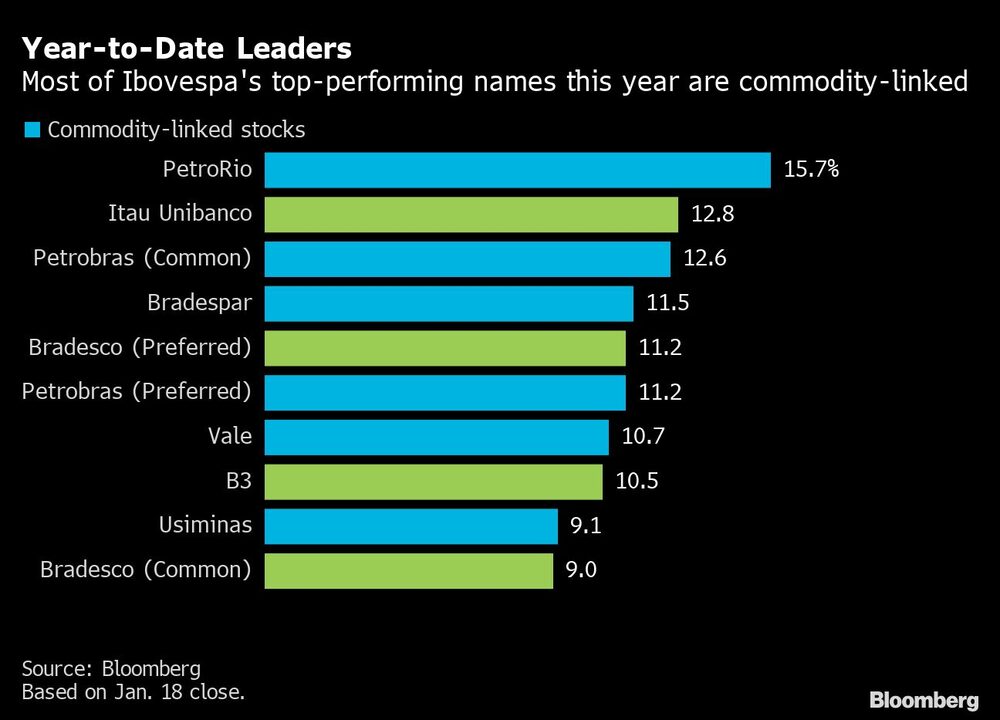

Another driver has been the strength in global commodity prices, which has traditionally helped the likes of iron-ore giant Vale SA and oil producer Petroleo Brasileiro SA, which combined account for nearly one third of the benchmark index. Six out of the top 10 performers on the Ibovespa so far this year are commodity-linked.

“We’ve seen a lot of momentum in materials and energy sector shares around the world,” said Morgan Harting, a senior portfolio manager at AllianceBernstein in New York. “Brazil’s market is heavier in those sectors than most.”

Election Caveat

Despite attractive multiples, the path ahead is unlikely to be smooth.

Brazil presidential election, scheduled for next October, will add greatly to market volatility. Political consultancy Eurasia Group said former President Luiz Inacio Lula da Silva has an advantage over incumbent President Jair Bolsonaro as the leftist pledges higher public spending in the aftermath of the pandemic.

Still, for some like Mirae’s Dorson, potential political upheaval is well accounted for in the current prices for some stocks.

“There are enough inexpensive opportunities right now creating a margin of error where you don’t have to play the politics one way or the other,” he said.

The MSCI Brazil Materials Index closed 3.2% higher on Wednesday, at the highest in four months.