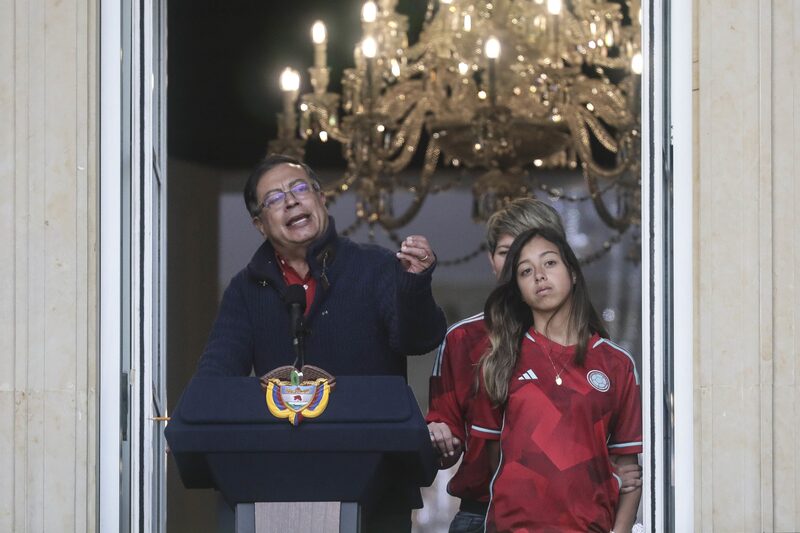

Bloomberg — Gustavo Petro’s push to overhaul Colombia’s conservative economic model is once again rattling financial markets.

In the span of a few days this month, Petro introduced a bill to transform the health system, vowed to scale back the role of pension fund managers and signed a decree that will allow him to cut energy tariffs.

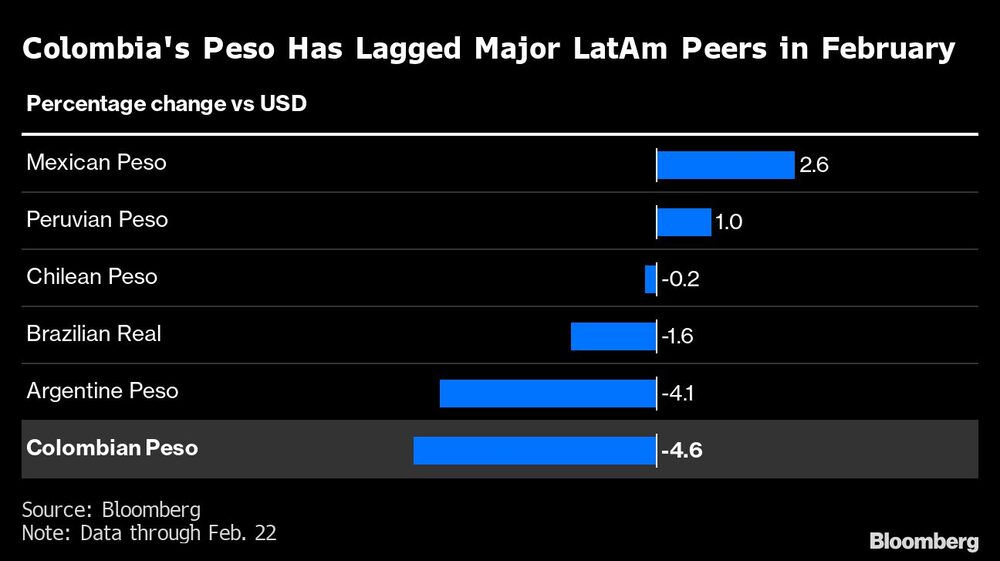

The result was a rapid selloff, with the country’s currency, bonds and stocks plummeting as investors weigh how far the leftist president will take his reforms. The cost of insuring against default — known as credit default swaps — rose more than any other Latin American peer this month. And peso-denominated debt, which is heavily dependent on foreign buyers, has fallen the most in emerging markets.

“Investors are becoming increasingly concerned about the signals coming from the Petro government,” said Jared Lou, a money manager at William Blair Investment Management LLC. “Petro has an ambitious social agenda during a period of time where the macro backdrop is weak, which will make it more challenging to find the resources to fund his social agenda responsibly.”

Petro’s presidency has been an enigma for the market ever since he took office in August. Many investors braced for radical changes, while others guessed the career politician would prove to be moderate after he named well-known economist Jose Antonio Ocampo to lead the finance ministry.

One thing they can agree on: Petro has moved at a startling clip at the beginning of his four-year term with a series of major overhauls — from taxes to vows to stop new oil drilling — in the months since he took over.

The latest proposals — on the pension and health systems — have caused further consternation.

Petro proposed a bill last week that would slash the role of private insurers in the health care system — a controversial topic that faced push back from allies in congress and even some of his own cabinet members. The following day, he amped up his anti-business rhetoric by attacking “two bankers” he says are getting rich by using the pension system to the detriment of workers, making a case for a reform that would limit the role of private fund managers.

The health reform “sends a signal that Petro is doing policy not based on pragmatism —fixing only the things that don’t work— but mostly based on ideology,” said Benito Berber, chief Latin America economist at Natixis. “If passed, it will indicate that other anti-market reforms, like the labor and especially the pension reform, will be easily approved.”

Colombia’s peso bonds, known as TES, have lost more than 10% so far this month, the worst performance in a Bloomberg index of local currency, emerging-market debt which is down an average 2.7%. The currency has plunged more than 4% in the same period, among the worst performers in Latin America.

It’s not the first time Petro has unnerved investors.

In October, the peso weakened to record lows after he reiterated a plan to halt the awarding of new oil exploration licenses. Fossil fuels account for around half of the country’s export revenue.

His latest proposals add to a backdrop that is concerning investors: The dollar has strengthened, Colombia’s current-account deficit likely widened last year to above 6% of gross domestic product and inflation, standing at a more than two-decade high, has yet to peak. The economy, meanwhile, is set for a hard landing after the fastest expansion among major Latin American nations in 2022.

That’s translated into higher borrowing costs for the government as investors demand a higher yield to hold the nation’s securities and the weaker peso makes dollar-denominated borrowing more expensive. Colombia will pay the equivalent of 4.4% of GDP in interest for its bonds this year, up from 3.4% in 2021, according to estimates from the finance ministry.

Investors are watching upcoming local elections to gauge how far Petro can take his social reforms.

“As the country gets closer to the local elections in October, Petro seems likely to lose leverage to congress, which would likely expose the gap between what he proposes and what he can actually accomplish,” Barclays Plc economist Alejandro Arreaza and strategist Sebastian Vargas wrote in a Feb. 16 report.

Yet, the yields on Colombian bonds —both in pesos and dollars— are among the highest compared to its Latin American peers, according to data compiled by Bloomberg. That’s led investors to try to balance the Petro risk against the reward of high payouts.

“A lot of political negativity has already been priced in Colombia,” says Viktor Szabo, who runs an emerging-market bond portfolio at abrdn Plc in London.

Since late last year, abrdn has been gradually adding to its exposure to TES bonds, he said.

“We have room to add more, but not in a hurry,” Szabo said.

--With assistance from Maria Elena Vizcaino

Read more on Bloomberg.com