Bloomberg — The global market for initial public offerings is showing signs of life as a rebound in the stock market has emboldened companies to test investor appetite for new listings, particularly in Asia. But a full-fledged recovery looks distant.

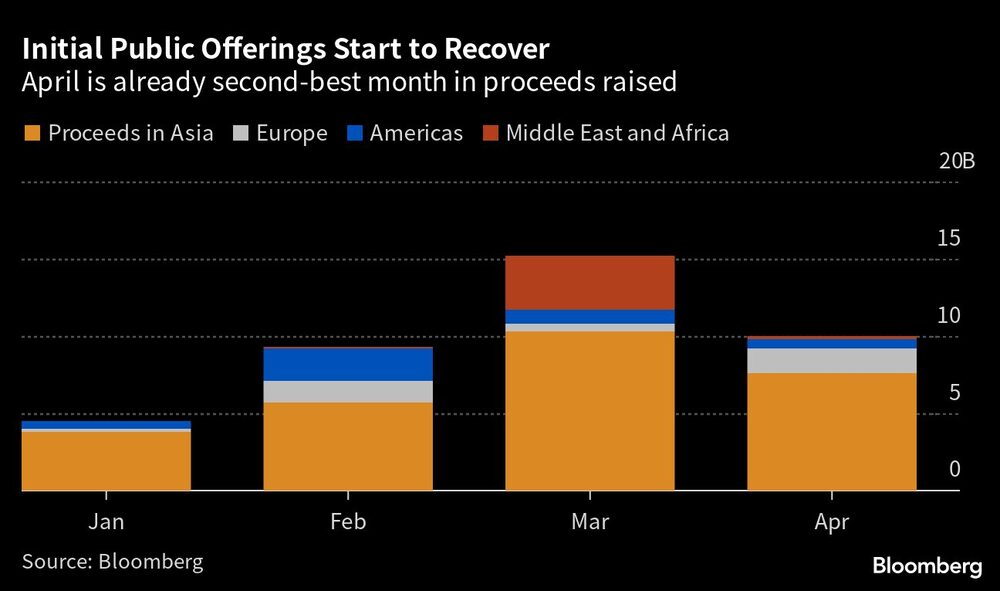

Roughly $25 billion worth of IPOs priced globally in March and April, nearly twice the amount seen in the first two months of the year when listings virtually ground to a halt, according to data compiled by Bloomberg.

Issuers from Hong Kong to Milan saw a window of opportunity with the decline in market volatility, according to analysts. Activity was particularly buoyant in Asia, where regional exchanges accounted for nearly 80% of new share sales in April. Listings in Europe also picked up. But concern about a recession has deterred US issuers, slowing a full-fledged recovery. Deal sizes on average were smaller, and the money raised so far this year remains 51% below the same period last year.

“We are beginning to see green shoots of activity with companies restarting processes that were on hold, but there is still a fair degree of uncertainty in the market,” said Jason Manketo, global co-head of law firm Linklaters’ equities practice. “The buy side is keen to see results for a couple of quarters before committing to an IPO. This means the potential pipeline of some 2023 deals has been moved out to 2024.”

Asia Leads

Drilling down into the data, Asia is handily the busiest area for offerings in the world right now. But in a key change compared to 2022 — when the vast majority of large-sized deals were concentrated in mainland China — issuance is coming from a broader swath of Asia this year.

Indonesia has been the brightest spot with a pair of nickel producers surging in their debut. Rakuten Bank Ltd. soared after raising 83.3 billion yen ($623 million) in Japan’s largest IPO since 2018 — though, the pop came after the initial price range had been cut. And KKR & Co.-backed Chinese liquor company ZJLD Group Inc. on Thursday priced Hong Kong’s largest offering of 2023.

“The IPO market is coming back gradually and slowly. It is not 100% back yet, but there are signs of life and renewed vigor,” said James Wang, co-head of equity capital markets at Goldman Sachs Group Inc. in Asia ex-Japan.

Europe Wakes Up

Europe’s IPO market has been moribund, with 2023 activity down about 12% from the same period last year when Russia’s invasion of Ukraine brought listings to a screeching halt.

Poor IPO returns have been a major deterrent for investors. Portfolio managers have been driving hard bargains on valuations and refusing to pay top dollar for new, unproven companies. Plus, the sudden meltdown of Credit Suisse Group AG, which ignited a global market rout last month, has added to investor worries about interest rates and inflation, further muddying listing plans.

But there have been signs of gloom lifting. Most notably, Lottomatica SpA, the Italian gambling company backed by Apollo Global Management Inc., opened books last week for a €600 million ($657 million) IPO, becoming the third large firm to tap European exchanges this year. Additionally, German web-hosting company Ionos SE and electric motor component maker EuroGroup Laminations SpA have managed to raise more than $400 million in the region, though both stocks have struggled after debuting.

US Falling Behind

Still, the outlook for IPOs in the US remains challenged. Only $4.1 billion has been raised for companies listing on US exchanges this year, with just three — Nextracker Inc., Atlas Energy Solutions Inc. and Enlight Renewable Energy Ltd. — accounting for a third of that amount.

In fact, outside that cluster and a dozen SPACs that have debuted this year, the vast majority of new listings would be qualified as penny stocks.

“We’re still in an uncertain world and uncertainty is the worst thing for new issuances,” said Greg Martin, co-founder of Rainmaker Securities, which facilitates secondary transactions for private companies.

Evidence is mounting the US may be headed toward a recession and the Federal Reserve’s path forward on interest rates remains unclear.

“How do you price a deal when you don’t know what the cost of capital really should be on a forward-looking basis,” said Patrick Galley, CEO & CIO of RiverNorth Capital Management. “Some clarity over interest rates is key.”

Read more on Bloomberg.com