Bloomberg — Three days before Colombians head to the polls for presidential elections, the mood in the bond market is uneasy. The rise of Gustavo Petro, a former guerrilla-turned-leftist politician, is unnerving traders who worry that the economic model that the nation has practiced for decades -- a combination of fiscal discipline and a heavy dose of free markets -- could be dismantled.

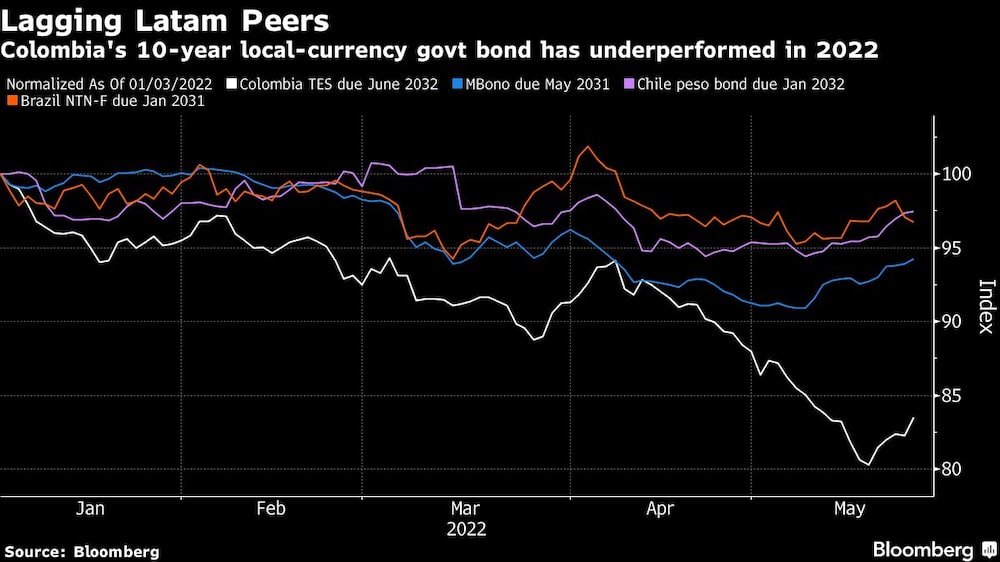

The government’s foreign bonds are among those in a region that has been hit hard by the global rout in debt markets this year, and yields on its local notes have spiked to their highest levels in more than a decade. Credit default swaps surged and now top those of Brazil, which has a junkier rating.

There are forces building that could mitigate, or even reverse, these losses. The economy is booming as is international demand for the country’s commodity exports. Also Petro could either suffer a surprise defeat or, if elected, choose a more centrist tack than his rhetoric has indicated, as has been the case with recently elected leftist leaders in neighboring Peru and Chile.

Analysts at some firms argue that, as a result, now is the time to start buying up Colombian bonds on the cheap, but few investors have been willing so far to bet big on a rebound. It’s just too risky as they see it, given all that could go wrong. Petro has already spooked markets with his plans to halt oil exploration -- the nation’s biggest export -- and tax large landholdings.

The runner-up on the race is Federico “Fico” Gutierrez, a former Medellin mayor who has vowed to cut deficits and regain the nation’s investment-grade rating. Businessman Rodolfo Hernandez, who has seen a recent surge in support, also could dispute the likely runoff on June 19.

“Uncertainty prevails,” said Gabriel Szpigiel, who oversees $5 billion in emerging market bonds at Marathon Asset Management. “The policy unknown will determine if Colombia becomes an more attractive or riskier investment.”

Here are some of the more prominent bearish and bullish views on the bonds ahead of the Sunday vote. Market reaction to the outcome will only be seen on Tuesday, as Monday is a holiday in the US and Colombia and local markets will be closed.

Alejandro Arreaza, an economist at Barclays whose contrarian views in El Salvador and Ecuador have panned out over the last year:

- Risks from Sunday’s vote are skewed to the upside. High growth, soaring oil prices as well as a moderate congress will keep the country on a stable financial path, regardless of who wins, he said

- “We keep a constructive view,” said Arreaza, whose firm has an overweight recommendation on the country’s dollar notes. “In the case of a Petro win, the checks and balances contain the risk of radical changes in the political framework - and if Gutierrez or Hernandez win, that can help dissipate some of the market’s concern”

Kathryn Rooney Vera, Miami-based head of global macro research at Bulltick LLC who has been recommending adding exposure to Colombia:

- “We think a Petro presidential win while not market friendly, is already priced in. If Petro surprises and loses, Colombia assets are likely to soar”

- “Even if he does win, given the congressional election outcome, we believe his ability to execute populist agenda will be mitigated”

- “We have been recommending long positions in Colombia as we have seen the bonds favorably priced relative to rating peers such as Brazil,” she said

Gorky Urquieta, a Chicago-based money manager at Neuberger Berman:

- “It’s very tempting to use that playbook of Chile and Peru. But we still have the election to play out and most likely is going to go to the second round,” he said

- “To the extent that Petro has a comfortable enough lead into the first round it’s possible he doesn’t moderate. Colombia is a pretty conservative country -- a lot of the potential policies he’s proposed have the risk of taking some of the vote away”

Jared Lou, a portfolio manager at William Blair Investment Management, who’s been reducing exposure to the nation’s credit as the election approaches:

- “Petro would increase uncertainty and decrease investment,” he said

- “The interesting question is the worst case scenario has already been priced. The answer, honestly, is we don’t know”

- “Even if Petro wins he’s going to have to work with congress. He wont be as radical as people fear him to be”

Andrea Kiguel, Alvaro Mollica and Dirk Willer , analysts at Citigroup wrote in a note:

- “Markets will be looking for signs that Petro will moderate, if he in fact wins,” they wrote. “Our overall expectation is that there will be a post-election rally in Colombian assets”

- It’s better to wait for closer to the second round before engaging in long trades on the nation’s assets, they said

Felipe Camargo, senior economist at Oxford Economics:

- “If Gustavo Petro pushes through his populist agenda, we expect depleted fiscal credibility to depreciate the peso (USDCOP) 9% against the US dollar, and a 1% structural increase in interest rates, while simultaneously dealing with increased risks of lower growth and higher inflation”

- The peso would trade closer to COP4,850 per dollar by 2026 against a baseline forecast of COP4,450 per dollar.