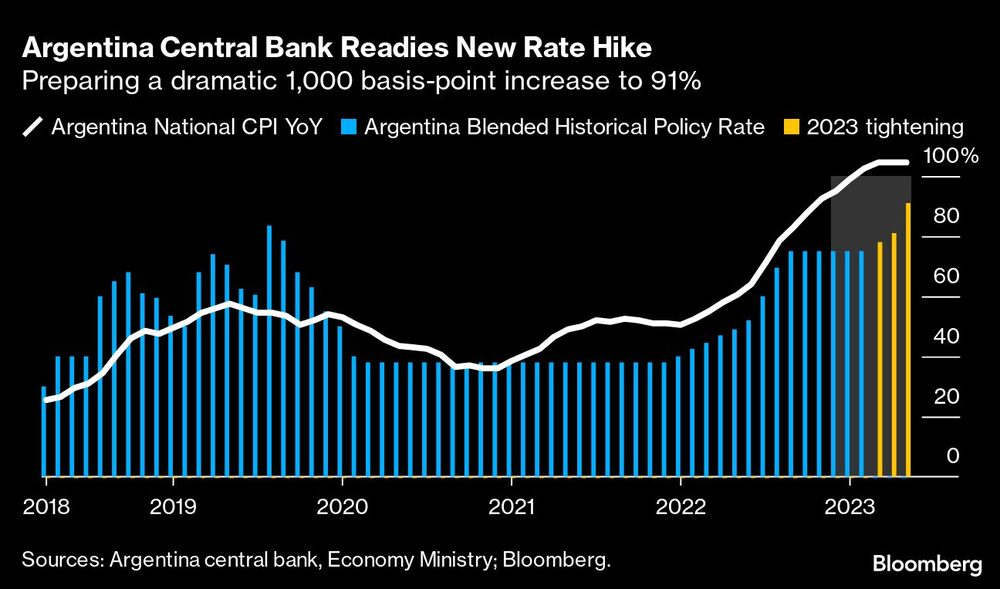

Bloomberg — Argentina’s central bank raised its benchmark interest rate by 1,000 basis points on Thursday as a renewed peso selloff in parallel markets adds to the sense of crisis in the South American nation.

The board boosted its key Leliq rate to 91%, the bank said in an emailed statement Thursday, the highest in at least five years. The bank said its decision is aimed at seeking real positive returns on local currency investments and preserving monetary and financial stability. The Argentine Economy Ministry first announced its intention to increase the rate in a statement sent by message.

It’s the biggest rate hike in the three years and a half years of President Alberto Fernandez’s administration. The central bank, which typically decides on its rate levels on Thursdays and doesn’t have a precise time to release a statement, isn’t independent and is headed by a Fernandez ally.

The move by the bank known as BCRA is also the second rate increase in as many weeks as the government works to stop a sharp decline in the country’s currency in parallel markets with annual inflation running at over 100%. That backdrop is challenging policymakers’ efforts to avoid a sharp devaluation on the official exchange rate, which is managed by currency controls.

The parallel rate, known by its Spanish acronym CCL, strengthened 2.2% to 460 pesos per dollar Thursday after Reuters first reported on the possible rate hike. Still, the currency lost 13% last week.

Lifting rates comes on top of other recent emergency measures, such as the central bank tapping a swap line from China to finance imports or intervening in financial markets even as the International Monetary Fund warns against such a strategy.

Earlier this week, Economy Minister Sergio Massa vowed to use “all the tools of the state to stabilize this situation” and halt the collapse in the nation’s parallel exchange rates.

--With assistance from Philip Sanders

Read more on Bloomberg.com