Bloomberg — The Brazilian real’s (USDBRL) rally is gaining steam as soaring prices for its commodity exports and one of the world’s highest interest rates fuel a lucrative carry trade for investors.

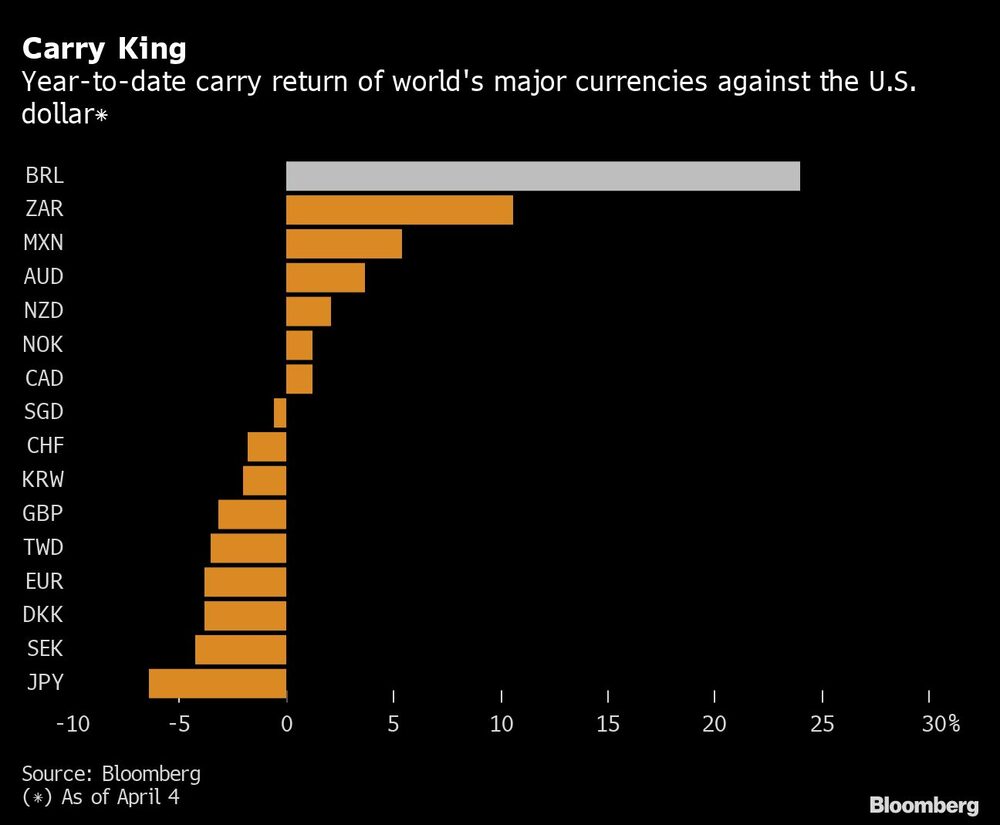

Swiftly rising rates and the best performance for raw-materials prices in 30 years ignited a breakout start to the year. The carry trade -- what investors make by borrowing in dollars and buying local notes -- has produced a 24% return since the end of December, the most worldwide and more than two times the gain for the runner-up.

It’s a dramatic turnaround for a currency that has weakened in each of the past five years, dropping 40% against the dollar (BRLUSD) in the span as the economy stagnated and foreign investment dried up. Now, with analysts touting a favorable political outlook and increased demand for Brazil’s oil, soy and iron-ore fueling record exports, the real is extending its biggest quarterly advance since 2009.

The gains in Brazil are a respite for global investors stung by losses in most other markets this year, from U.S. stocks to government bonds to corporate credit.

“Where else can money go?” said Danny Fang, a strategist at Banco Bilbao Vizcaya Argentaria SA in New York. The bank was among the top forecasters for the real in the first quarter, according to Bloomberg rankings.

The real has jumped 21% this year to a two-year high near 4.6 per dollar, bolstered by the central bank’s aggressive tightening to fight inflation. With the exception of Russia, no other country in the world lifted rates as much as Brazil over the past year. The benchmark rate is up 9.75 percentage points and may be increased by another full point next month before officials end the hiking cycle.

With interest rates expected to remain elevated until at least the end of the year amid persistently above-target inflation, the real is likely to keep its preferred status among carry traders. Even as borrowing costs tick up globally, Brazil’s interest-rate differential to the U.S. exceeds 11 percentage points; it’s 10 points above the mean in Asia and 5 points higher than the Latin American average.

“Brazilian bonds and the real are standing pretty far out of the emerging-market pack,” Joana Freire, a money manager at Eurizon Capital in London, wrote in a report last month.

The yield on Brazil’s 10-year local-currency bonds has climbed about 450 basis points since the start of 2021 to 11.3%, the second highest among major developing economies -- only behind Russia. It’s also about five times the equivalent Treasury rate, even after the U.S. bond market went through the most brutal quarter of modern times due to expectations of a more aggressive Federal Reserve policy.

Brazilian assets also offer the benefit of being far away from the Ukraine war. Unlike many developing nations in Europe, Brazil doesn’t have strong trade links with Russia and is expected to be less affected by the conflict and economic sanctions.

The Latin American nation is also benefiting from the commodities boom triggered by global supply shocks caused by the war. Raw materials including iron ore, crude, soybeans and sugar account for about 70% of the nation’s exports, and prices have been soaring. The 25% gain for the Bloomberg Commodities Index last quarter was the biggest since 1990.

All of that has attracted a wave of dollars to the country. Non-residents have slashed their bearish bets on the real against the dollar by $5.1 billion since March 14, according to local exchange data compiled by Bloomberg.

While rising interest rates are usually bad for stocks, that hasn’t been the case in Brazil, where the Ibovespa index has jumped 39% in dollar terms since the start of the year, the most among the 92 equity benchmarks tracked by Bloomberg. Foreign investors added about 64.1 billion reais ($13.9 billion) in that period, the most for any quarter since at least 2008.

The real is now stronger than the most bullish forecast compiled by Bloomberg, and the mean estimate now predicts a 14% loss by year-end. Bears see a rocky road for the currency amid the potential for political turmoil and government overspending tied to this year’s presidential election.

But investors view that concern as overblown. They’ve grown more comfortable with front-runner Luiz Inacio Lula da Silva, President Jair Bolsonaro’s main opponent as the incumbent seeks re-election. The thinking is that whoever wins the election will pursue policies that will bolster the economy.

“Fundamental drivers remain there: high carry, local assets appear cheap, political/fiscal risks seem contained in the near term,” said Juan Prada, a New York-based currency strategist at Barclays Capital Inc., the most accurate forecaster for the real in the first quarter, according to Bloomberg rankings. “Momentum remains strong, though the speed of the rally surprised me.”