Bloomberg — With Bitcoin, it all depends on the lens. Zoom in, and the world’s biggest cryptocurrency seems to be enjoying a robust little rally, gaining more than 10% since last Monday for one of its best such stretches of the year:

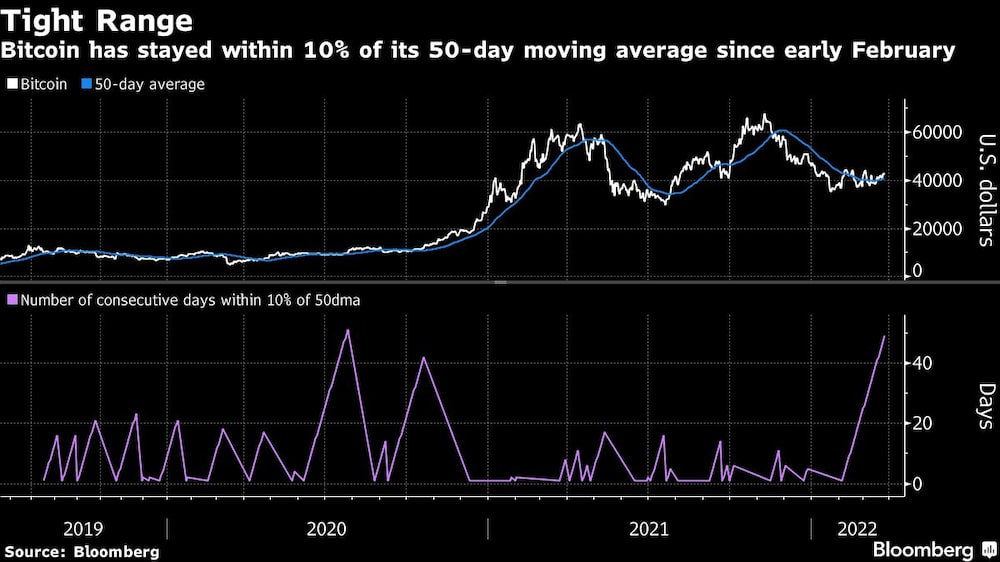

Zoom out, though, and it’s a different picture. Even with its recent gains, Bitcoin (XBN) is still well within the narrow province it has inhabited for most of the year. The coin has wobbled inside a 10% range of a key trend line -- its average price over the past 50 days -- for 49 straight sessions, the longest stretch since July 2020, according to data compiled by Bloomberg. On Thursday, Bitcoin was trading at about $43,000 as of 10 a.m. in New York for a gain of about 1.5%.

Bitcoin’s doldrums set in after its price slumped by roughly 40% from a high in November of near $69,000, a downward move that was followed by the broader Bloomberg Galaxy Crypto Index. And it’s a trend many experts see persisting for the foreseeable future. Is this what crypto winter looks like in 2022?

“Bitcoin has no real catalyst to push it higher,” said Leah Wald, CEO at digital-asset investment manager Valkyrie Funds.

In a world of tightening monetary policies and higher interest rates, old tropes that helped prop up arguments for owning crypto -- including that Bitcoin is a safe place from rampant central-bank money printing and a hedge against inflation -- aren’t working anymore. “Money printer go brr” memes are no longer omnipresent on Twitter; meantime, the Federal Reserve is working on dousing the inflation crypto is supposed to protect against. Even war is poking holes in well-worn narratives: Despite crypto’s selling point as a preferred store of value and alternative to the dollar-run global monetary system, it hasn’t gained ground as much of a refuge or haven since Russia’s world-shaking invasion of Ukraine, nor has it proved itself as a good place to hide.

Many crypto investors are re-evaluating their riskier holdings as the Fed raises rates and signals it could move even more aggressively. That suctions away cash that otherwise might have been deployed toward crypto or other high-growth areas of the market. Noted Bitcoin-investor Mike Novogratz weighed in recently, saying the coin is likely to trade in a range all year as the Fed continues to raise rates. It’s also difficult to bring in new investors against the backdrop of the war in Ukraine and other upheavals.

Some market-watchers say the narrative playing out now is the developing struggle between long- and short-term holders. Long-term traders have been stepping in during downdrafts, while short-term ones have been selling at every rally as they try to break even. The result means Bitcoin remains stuck, reinforcing the current trend.

“This is the ultimate story that’s playing out in crypto markets at the moment,” Noelle Acheson, head of market insights at Genesis Global Trading, said on Bloomberg’s “QuickTake Stock” stream.

Volatility traders “are staying away because of the heightened level of uncertainty. We also know that there’s still a lot of accumulation going on on Bitcoin -- the long-term holders are still accumulating,” she said. “So we do have this long-term thesis playing out under the surface of the price movements that are lackluster.”

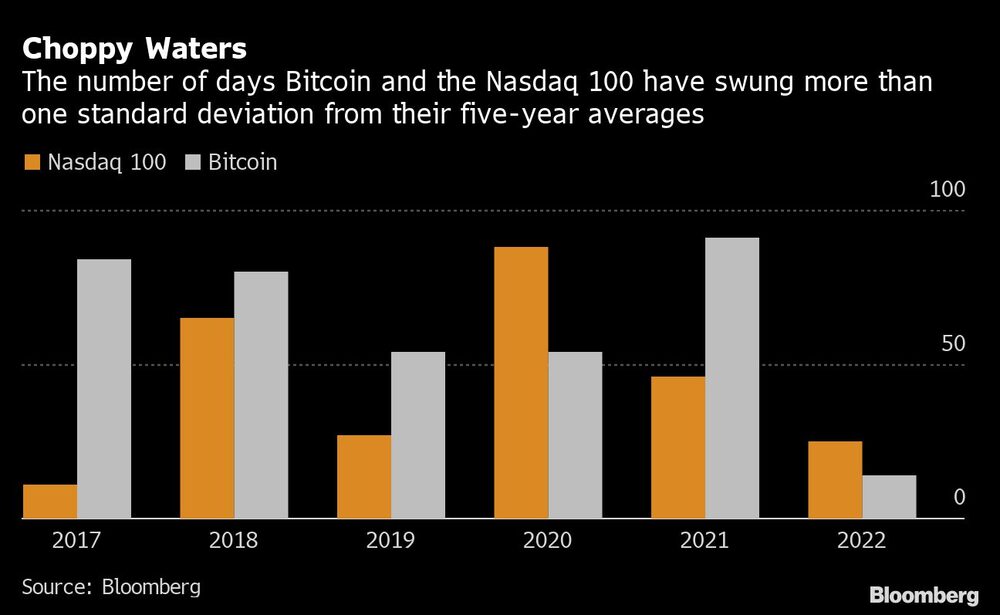

One surprising consequence of the coin’s dull dance is that it’s become less volatile than U.S. equities, at least in the short run, prompting Twitter posts about “boring” Bitcoin. Based on five years of price movements, Bitcoin had, as of the start of the week, moved more than one standard deviation from its average in either direction just 14 times so far this year, according to data compiled by Bloomberg. That compares to 25 times for the tech-heavy Nasdaq 100 index. The only other time that’s happened in the last five years was in 2020.

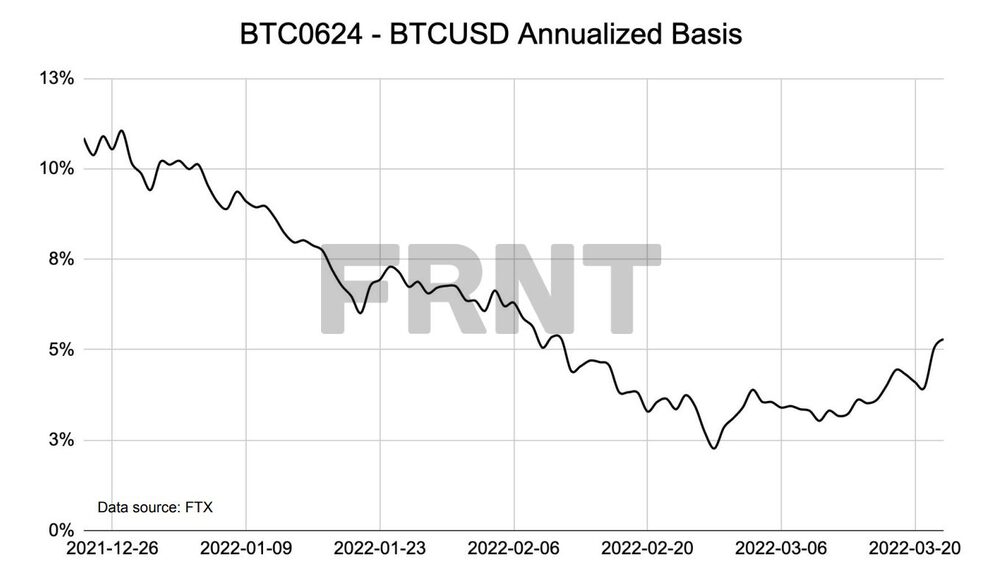

And that’s not all: A nearly risk-free trade favored by big institutions -- which looks at the difference between Bitcoin futures and the digital currency’s price -- was, ahead of Bitcoin’s November record run, indicating investors were bullish about it continuing to rally. That spread has now narrowed, and data over the last 30 days suggests an average annualized return of just 3.58%, according to Strahinja Savic, head of data and analytics at FRNT Financial, an institutional crypto platform.

“We are neither in an aggressive bull market, nor are we in a bear market,” he said of what the data show. “Bitcoin, and the broader crypto market, are seeing the effects of macro uncertainty caused by rate hikes, Russia-Ukraine conflict, et cetera.”

So where does Bitcoin go from here? Valkyrie’s Wald says its sideways-trading pattern had also been noted in previous years.

“We even were locked in virtually the same range last year before hitting all-time highs in the fall,” she said. “Given this, and the record amount of investment we are seeing in the industry across the board, the momentum is slowly building for another rally, even if this is not being reflected right now in price action. We would not be surprised to see another record high before the turn of the year.”

The space, which is no longer dominated by just a handful of coins, is attracting billions in investments. The crypto boundaries have expanded over the last few years and the infrastructure now also sustains gaming platforms, nonfungible tokens trading and decentralized finance, among other things.

Mati Greenspan, founder and CEO of Quantum Economics, says he hopes Bitcoin stays in its tight trading range for a while. “That’s extremely good for the industry as a whole because we know that when the price movement is a bit depressed or quiet, that’s the time when stuff gets built,” he said in an interview.

“If we end the year around $40,000, I wouldn’t complain at all, I would be pretty happy,” Greenspan said, adding that he doesn’t rule out a run toward $60,000 or $70,000 again.

--With assistance from Lu Wang.