Bloomberg — Brazil’s central bank signaled plans to end one of the world’s most aggressive cycles of interest rate increases at its next meeting in May as long as commodity prices remain relatively steady.

Policy makers reiterated plans for another rate hike of one percentage point at their next decision, according to the minutes of the March 15-16 meeting published Tuesday. Bank board members pointed out that they opted for timelier borrowing cost rises amid high inflation and uncertainty.

“The Committee concluded that a further adjustment of 1.00 percentage point, followed by an additional adjustment at the same pace, is the most appropriate strategy to achieve sufficient monetary tightening and to ensure inflation convergence over the relevant horizon, as well as the anchoring of long-term expectations,” they wrote.

Policy makers led by Roberto Campos Neto are calibrating one of the world’s biggest tightening cycles in the wake of the pandemic. Last Wednesday, they lifted the Selic to 11.75%, extending total borrowing cost hikes since last March to 975 basis points. Economist inflation forecasts for this year and next continued to rise further above target even after that increase.

What Bloomberg Economics Says

“The minutes of the March 16 policy meeting make it clear that the central bank’s base case scenario is of a final move in May, and it would take a persistent pressure in oil prices to convince them to extend the cycle.” --Adriana Dupita, Latin America economist

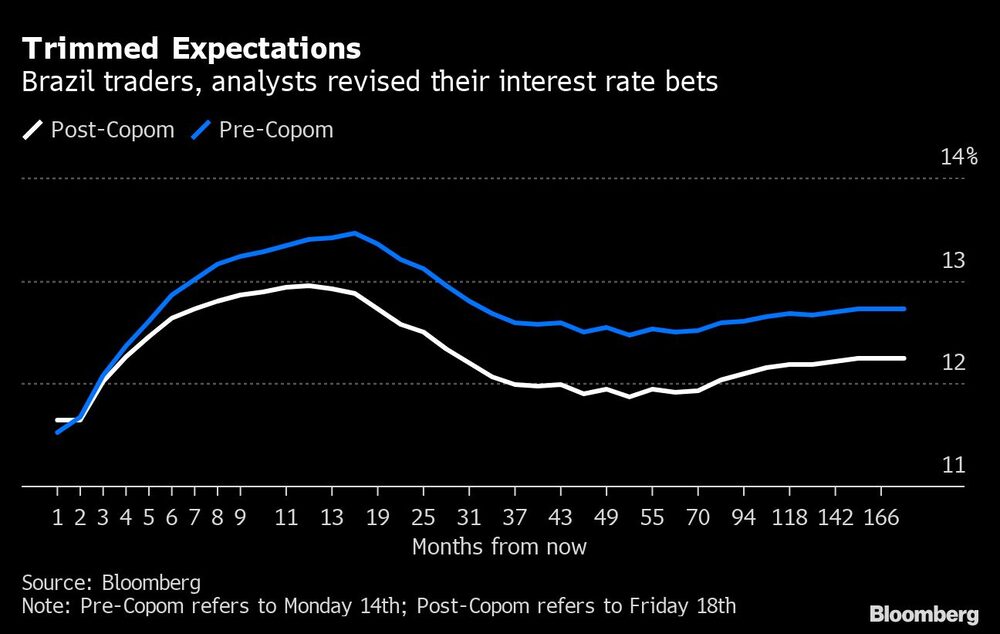

Swaps on the contract due on January 2023, which indicate investors expectations for interest rates, rose four basis points in morning trading as traders pondered how much longer the central bank will raise borrowing costs. The real gained 0.5% to 4.9140 per dollar.

‘Important Shock’

With the conflict in Europe adding “uncertainty and volatility,” policy makers wrote it’s more probable that oil prices converge to $100 per barrel by the end of the year.

Latin America’s largest economy has been stung by rising commodity prices and severe weather that’s making food staples more expensive. Compounding matters further, local oil company Petroleo Brasileiro SA increased fuel costs as much as 25%, propelling year-end inflation expectations even higher.

In the minutes, policy makers cited an acceleration in services price increases, as well as higher-than-expected readings from volatile components and core inflation.

“Central bankers sent the message, again, that their flight plan is to hike another 100 basis points in May and done,” said David Beker, head of Brazil economics for Bank of America Corp. “But, since their prior meeting, the war has generated an important shock for commodity prices. Given that, in theory, we should see higher inflation and, compared to previous estimates for interest rates, higher rates.”

Beker sees the benchmark Selic peaking at 13.25%.

Brazil’s central bank also faces tighter global financial conditions as the U.S. Federal Reserve begins lifting its interest rate. On Monday its chairman Jerome Powell said that, if needed, their hiking pace can be more rapid than currently expected as part of “necessary steps” to get inflation down.

Brazil analysts see inflation at 6.59% this year and 3.75% next. Policy makers’ own projections show consumer prices will converge to target in 2023. Central bankers target cost of living increases at 3.50% in 2022 and 3.25% in 2023.