Bloomberg — Group of 20 finance chiefs meeting in Indonesia will confront a much-altered global economy menaced by widespread inflation, the threat of war, and a legacy of disease.

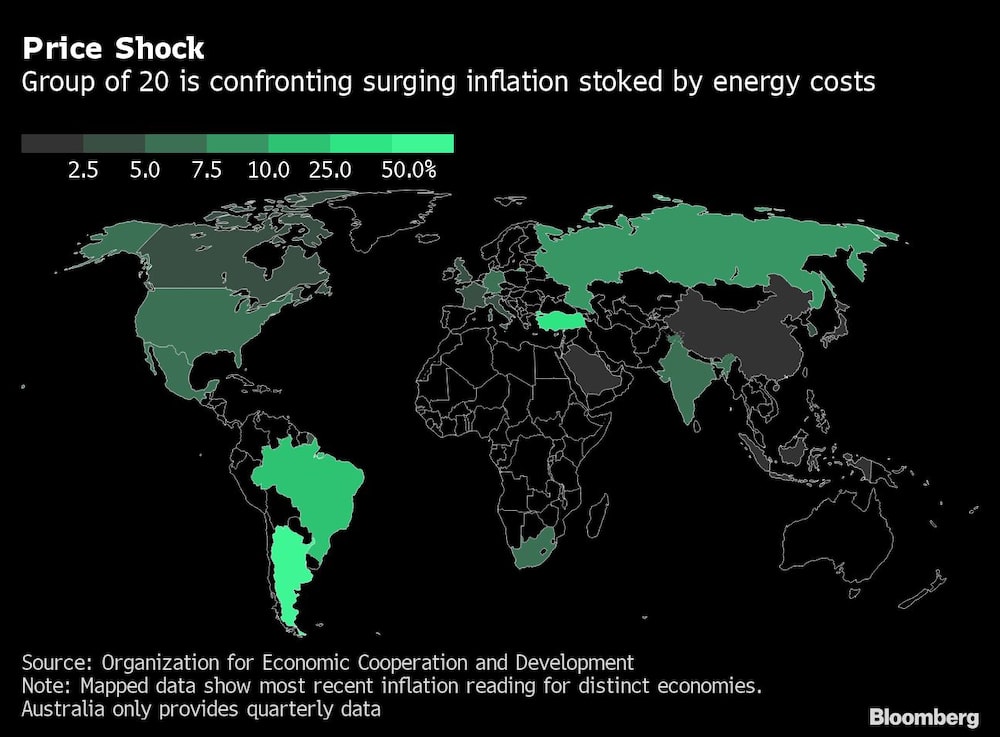

The scope of the consumer-price shock afflicting many member countries is unprecedented since the group’s foundation at the end of the last century, and has been stoked by persistent supply worries and soaring energy costs. Related to that last pressure is military tension with Russia that could yet transform into conflict in Ukraine.

The mixture of challenges facing finance ministers and central bankers meeting in Jakarta is likely to prompt a less sanguine view than offered in their Washington communique in October, when officials accepted some inflation as “transitory.”

The gathering on Thursday and Friday takes place a week after U.S. data showed consumer prices rising at the fastest pace in 40 years, stoking expectations of accelerated Fed tightening. Even the previously dovish euro-zone has changed its tune, while in Argentina and Turkey, both G-20 members, inflation is now running at close to 50%.

The global price shock isn’t affecting the group uniformly, though. Japan, which has long struggled to generate sustainable inflation, may see another slowing in data due this week, and China is likely also to report weakening pressures.

What may well become apparent from the meeting is the degree to which many governments are moving on to tackle newer worries than the coronavirus, even as the pandemic continues, albeit with the often less-dangerous omicron variant.

Elsewhere, U.K. inflation may accelerate again and U.S. producer prices could show some moderation. On the monetary front, the Federal Reserve will release decision minutes and the European Central Bank president will speak to lawmakers.

What Bloomberg Economics Says:

“If both the labor market and CPI data continue to show few signs of inflation easing, then the Bank of England is likely to lift interest rates in March.”

U.S.

Investors next week will get a second helping of January inflation data when the government issues figures on producer prices. Economists forecast that on a year-over-year basis the measure of prices paid to producers increased at a more moderate pace for a second month.

A sustained tempering of price pressures at the producer level would suggest an eventual easing in the recent run-up in consumer inflation. This past week, the U.S. consumer price index jumped a surprising 7.5% from January of last year, a four-decade high.

On Wednesday, investors will parse minutes of the Fed officials’ January meeting to gauge central bankers’ appetite for a more aggressive approach to policy normalization. Fed Chair Jerome Powell said last month that they were ready to raise rates in March and didn’t rule out moving at every meeting this year -- an outcome that Goldman Sachs, for one, is now expecting.

This coming week’s U.S. data calendar also includes reports on January retail sales, industrial production, housing starts and existing-home purchases.

Asia

Market watchers will focus on Japanese yields after the Bank of Japan acted to stem upward movement. The world’s third-largest economy releases growth figures Tuesday that should show the economy rebounding strongly, at least before omicron cases rocketed. Meanwhile, Japan’s inflation is expected to have slowed in January.

Minutes from the Reserve Bank of Australia’s last meeting may shed more light on the likelihood of a possible rate hike later in the year. Labor market data out Thursday may support more optimism Down Under, though Covid restrictions could still upset the numbers.

Jobs figures out of South Korea will be scrutinized by Bank of Korea Governor Lee Ju-yeol ahead of his final policy meeting later in the month.

China’s central bank will release results of its monthly liquidity operation on Tuesday, while the latest inflation data there lands on Wednesday.

Elsewhere in the region, the Philippines central bank meets Thursday, while Singapore releases its 2022 budget on Friday.

Europe, Middle East, Africa

U.K. inflation in January is likely to have taken another step higher en route to a peak that the Bank of England ultimately sees above 7%. While the median economist forecast for that data on Wednesday is for 5.5%, the range of predictions is wide, from a moderation to 5.1% to another jump as high as 6%.

The labor-market report the previous day is also likely to focus BOE policy makers, with signs of tightness likely to pave the way for further rate hiking. Governor Andrew Bailey blocked a half-point increase sought by some of his colleagues earlier this month, but investor bets now suggest such a move will come soon enough.

In the euro-zone, meanwhile, ECB President Christine Lagarde’s testimony on Monday will be another opportunity to guide investors after her recent hawkish pivot stoked expectations of rate hikes this year. Last week, though, she repeatedly stressed that any tightening will be gradual.

On Saturday, ECB Governing Council member Olli Rehn warned against an overreaction to the current inflation spike. “It’s better to look beyond short-term inflation and look at what inflation is in 2023, 2024,” he said in an interview on Finnish television.

The main data in the euro region will be industrial production for December on Wednesday, which will point to the health of economic growth in the overall fourth quarter.

In Poland and the Czech Republic, inflation data may show another acceleration toward 10%. An outcome above that level couple prompt policy makers in Prague to signal more rate hikes.

Turkey’s monetary officials might welcome consumer-price increases only of that magnitude; inflation there was almost 50% in January, more than triple the level of the benchmark rate. Nevertheless, the central bank is expected to keep policy on hold on Thursday.

In Israel, data on Tuesday may show price growth above 3% for the first time in more than a decade, which could tilt the central bank toward a more hawkish stance.

Namibia on Wednesday may increase its key rate by 25 basis points to safeguard its currency peg with neighboring South Africa and ensure its economy doesn’t miss out on foreign investors seeking higher yields.

The same day in South Africa, inflation data will probably stay close to the ceiling of the central bank’s 3% to 6% target range, underscoring the dilemma policy makers face as balance that with the economic fallout from the pandemic.

Latin America

Kicking off the week, the central banks of Brazil and Chile post closely-watched surveys of economists and traders respectively. Both monetary authorities published the minutes of their most recent meetings in recent days.

Colombia’s statistics agency also reports out a raft of December data, including industrial production, retail sales, manufacturing and trade.

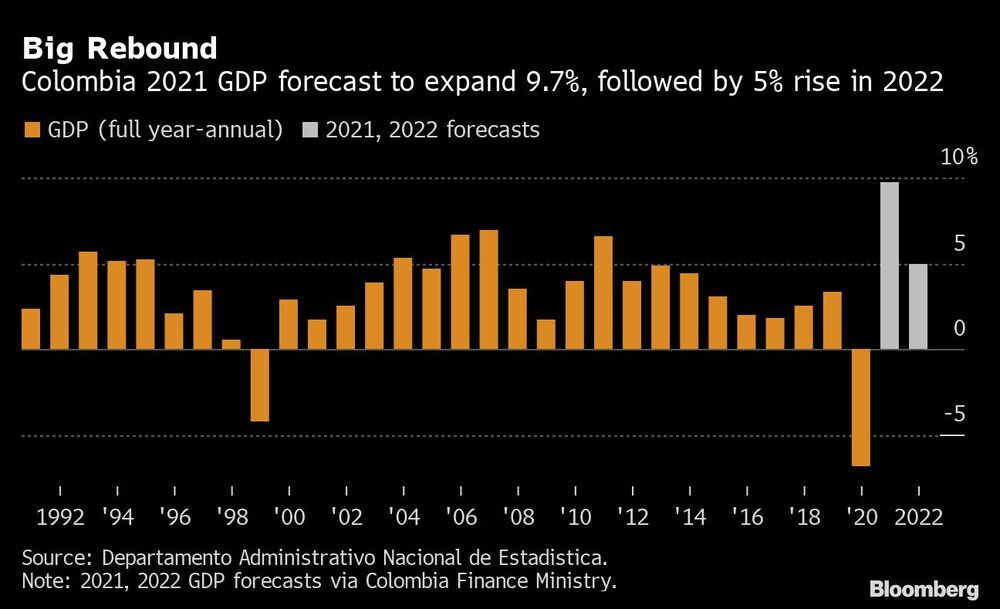

Look for data out Tuesday to show a strong but uneven economic rebound in Colombia pushed output further above pre-pandemic levels. The finance ministry is forecasting 2021 GDP growth of 9.7%, the fastest pace in decades, followed by a 5% expansion in 2022.

A light week for Brazil sees the publication of some early inflation readings for February along with weekly trade figures. Argentina on Tuesday posts its national and Buenos Aires inflation figures for January, while Peru publishes its December economic activity report along with labor market metrics in Lima, the nation’s capital.

Rounding out the week, Uruguay’s central bank has signaled that a second straight interest rate increase of 75 basis points is on tap, which would push its key rate to 7.25%. The monthly survey of economists by Colombia’s central bank may give a clue to the effect of still-accelerating inflation on 2022 and 2023 expectations.