Bloomberg — Mexico’s stock market is caught in a downward spiral that no one knows how to stop.

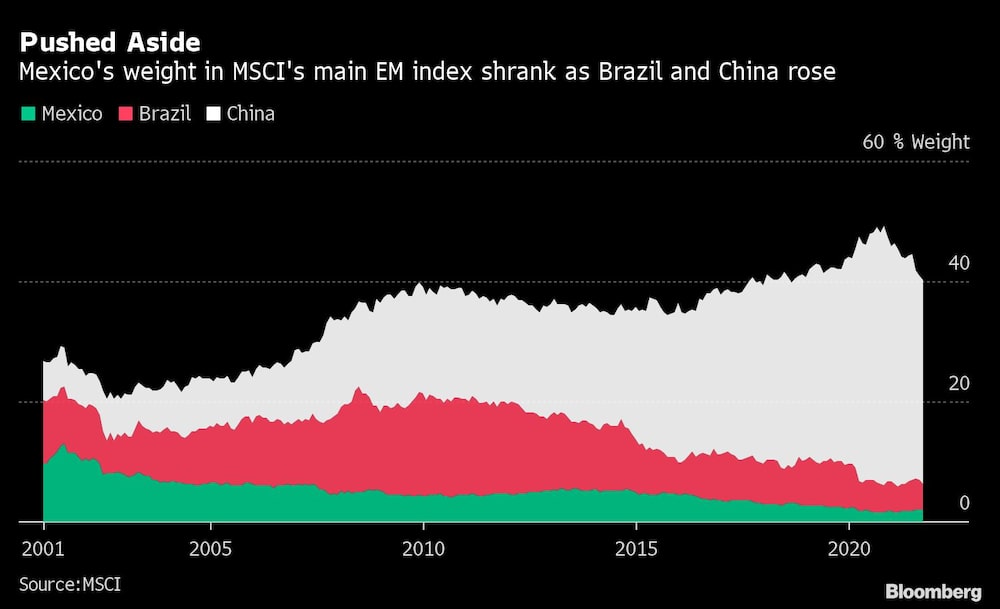

Local markets now trade more in foreign equities than domestic companies, while the number of stocks with $10 million of daily trading volume -- an informal threshold for international funds -- has fallen by almost half since the end of 2018. That followed a two-decade decline during which Mexico’s weighting in the benchmark stock index for developing nations withered as it was pushed aside by China and other more dynamic markets.

While places like Brazil, Hong Kong and the U.S. have seen record new listings this year, Mexico’s stock market has been shrinking as interest from both locals and foreign investors wilts. It’s threatening Mexico’s status as an emerging-market powerhouse and risks doing long-term damage to Latin America’s second-largest economy by limiting the ability of companies to raise funds from local investors.

“More and more, Mexico is a little bit less interesting for outside investors because the number of liquid companies is decreasing,” said Luis Carrillo, who leads the Latin America equities team at JPMorgan Asset Management. “The smaller the market gets, the less interesting it will be, and with that the cost of capital will increase.”

It’s a harsh turnaround for Mexico, which had led a boom in emerging markets during the 1990s but got left behind as countries like Brazil eased market regulations and investor attention turned to China to tap into faster economic growth and a bigger population.

The country’s weighting in MSCI’s main emerging markets index fell from a high of 13% in 2001 to a low of 1.6% in February. It has inched up since then as Mexican stocks outperformed peers, helped by links to the U.S. and its robust recovery from the pandemic crash.

“We see an ever-shrinking market,” said Rodolfo Ramos, a strategist at Bradesco BBI.

In recent years, policy uncertainty under President Andres Manuel Lopez Obrador has further weighed on the market, Ramos said. Lopez Obrador has sown legal uncertainty with his threats against private energy companies and some of the country’s business class since winning election in 2018. That’s slowed new investments and crimped growth.

Despite Mexico’s outperformance this year, Ramos said many of the biggest funds in Latin America remain underweight. “They haven’t turned any more constructive,” he said. “The narrative is still pretty bad.”

Lopez Obrador’s press office didn’t respond to a request for comment on whether his policies are affecting the market.

Amid the stagnation, the main stock exchange and a new rival bourse that started in 2018 have been unable to encourage more companies to list, and it’s now been 16 months since the last initial public offering. JPMorgan’s Carrillo said financial authorities have failed to reduce red tape and tax hurdles in the same way Brazil did to encourage companies to come to market.

“It is in the best interest to make that happen, but they don’t seem to care,” he said.

With no exciting new companies coming to market -- and other family businesses unwilling to list, market liquidity is drying up.

Only six stocks on the 35-company IPC index traded an average of at least $10 million a day during October. That is down from a peak of 16 stocks in 2013, when the economic reforms of former President Enrique Pena Nieto excited investors.

By comparison, 87 out of 92 companies on Brazil’s benchmark index traded above $10 million a day last month, including new companies that have listed in recent years such as Pet Center Comercio e Participacoes SA and Locaweb Servicos de Internet SA. Investors in Mexico keep trading the same names such as retailer Wal-Mart de Mexico SAB and Carlos Slim’s America Movil SAB.

The country’s top traded stocks underscore another one of the problems holding Mexico back: the preponderance of a few powerful companies that have crowded out the room for new competitors. William Pruett, who manages Fidelity Management and Research Co.’s main Latin American fund, said Mexico’s regulators have failed to help foster startups while allowing firms to remain dominant in their sectors.

“It is such a concentrated market,” he said. “You don’t have the breadth of options in Mexico that you have in Brazil.”